Question: Give detailed solutions please We consider a portfolio optimization problem where there are three types of assets to invest and a total budget of $100.

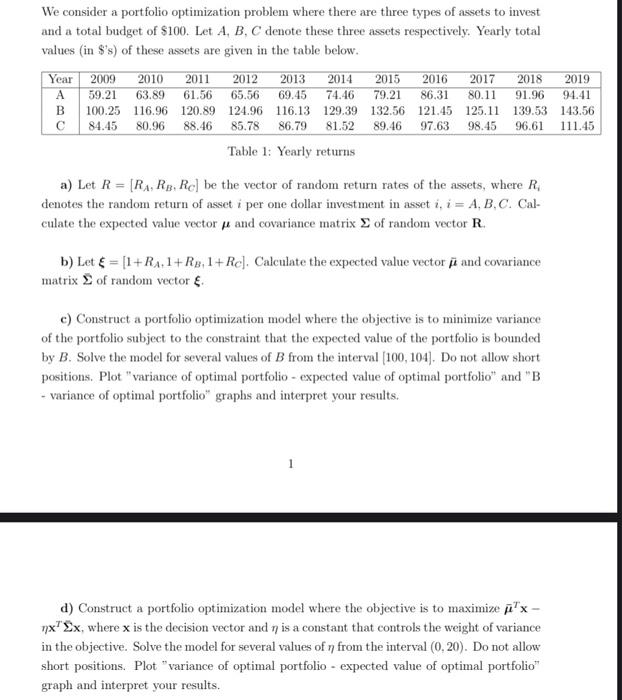

We consider a portfolio optimization problem where there are three types of assets to invest and a total budget of $100. Let A,B,C denote these three assets respectively. Yearly total values (in $ 's) of these assets are given in the table below. Table 1: Yearly returns a) Let R=[RA,RB,RC] be the vector of random return rates of the assets, where Ri denotes the random return of asset i per one dollar investment in asset i,i=A,B,C. Calculate the expected value vector and covariance matrix of random vector R. b) Let =[1+RA+1+RB,1+RC]. Calculate the expected value vector ~ and covariance matrix of random vector . c) Construct a portfolio optimization model where the objective is to minimize variance of the portfolio subject to the constraint that the expected value of the portfolio is bounded by B. Solve the model for several values of B from the interval [100,104]. Do not allow short positions. Plot "variance of optimal portfolio - expected value of optimal portfolio" and "B - variance of optimal portfolio" graphs and interpret your results. 1 d) Construct a portfolio optimization model where the objective is to maximize Tx xTx, where x is the decision vector and is a constant that controls the weight of variance in the objective. Solve the model for several values of from the interval (0,20). Do not allow short positions. Plot "variance of optimal portfolio - expected value of optimal portfolio" graph and interpret your results

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts