Question: Give me 100% correct answer QUESTION NO. U ABC Ltd. is considering a project in US, which will involve an initial investment of us 48

Give me 100% correct answer

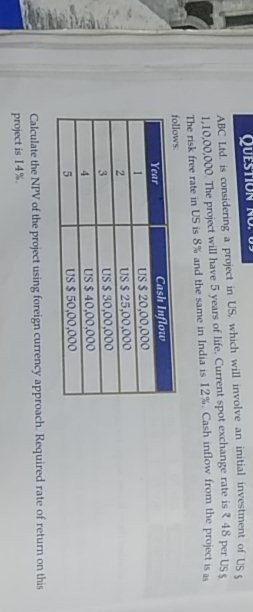

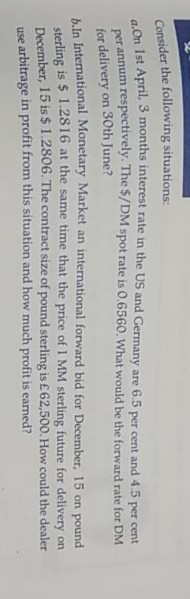

QUESTION NO. U ABC Ltd. is considering a project in US, which will involve an initial investment of us 48 per USS 1.10,00.000 The project will have 5 years of life. Current spot exchange rate is The risk free rate in US is 8% and the same in India is 12% Cash inflow from the project is follows Year 2 Casli Inflow US $ 20,00,000 US $ 25,00,000 US $ 30,00,000 US $ 40,00,000 US $ 50,00,000 Calculate the NPV of the project using foreign currency approach. Required rate of return on this project is 14% Consider the following situations: Ist April, 3 months interest rate in the US and Germany are 6.5 per cent and 4.5 per cent annum respectively. The S/DM spot rate is 0.6560. What would be the forward rate for DM for delivery on 30th June? International Monetary Market an international forward bid for December, 15 on pound sterling is $ 1.2816 at the same time that the price of I MM sterling future for delivery on December, 15 is $ 1.2806. The contract size of pound sterling is 62,500. How could the dealer use arbitrage in profit from this situation and how much profit is earned

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts