Question: give me five type answer Stocks A and B each have at expected return of 12%, a heat of 1, 2, and a standard deviation

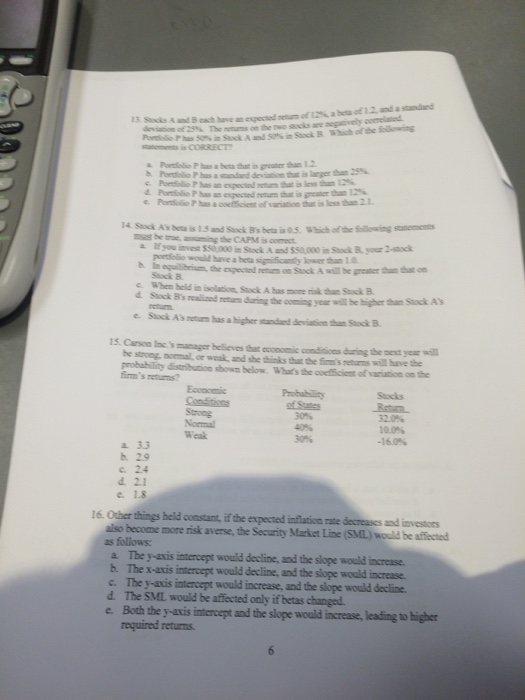

Stocks A and B each have at expected return of 12%, a heat of 1, 2, and a standard deviation of 25%. The returns on the two stocks are negatively correlated. Portfolio P has 50% in Stock A and 50 in Stock B. Which of the following statement is CORRECT? Portfolio P has a beta that is greater than 1.2. Portfolio P has a standard deviation that is larger than 25%. Portfolio P has an expected return that is less than 12%. Portfolio P has an expected return that is greater than 12%. Portfolio P has a coefficient of variation that is less than 2.1. Stock A's beta is 1.5 and Stock B's beta is 0.5. Which of the following statements must be true, assuming the CAPM is correct. If you invest % 50,000 in Stock A and $50,000 in Stock B, your 2-stock portfolio would have a beta significantly lower than 1.0. In equilibrium, the expected return on Stock A will be greater than that on Stock B. When held is isolation, Stock A has more risk than Stock B. Stock B's realized return during the coming year will be higher than Stock A's return. Stock A's return has a higher standard deviation than Stock B. Carson Inc.'s manger believes that economic conditions during the next year will be strong, normal, or weak, and she thinks that the firms' returns will have the probability distribution shown below. What's the coefficient of variation on the firm's returns? Economic Probability Stocks Conditions of States Return Strong 30% 32.0% Normal 40% 10.0% Weak 30% -16.0% 3.3 2.9 2.4 2.1 1.8 Other things held constant, if the expected inflation rate decreases and investors also become more risk averse, the Security Market Line (SML) would be affected as follows: The y-axis intercept would decline, and the slope would increase. The x-axis intercept would decline, and the slope would increase. The y-axis intercept would increase, and the slope would decline. The SML would be affected only if betas changed. Both the y-axis intercept and the slope would increase, leading to higher required returns. Stocks A and B each have at expected return of 12%, a heat of 1, 2, and a standard deviation of 25%. The returns on the two stocks are negatively correlated. Portfolio P has 50% in Stock A and 50 in Stock B. Which of the following statement is CORRECT? Portfolio P has a beta that is greater than 1.2. Portfolio P has a standard deviation that is larger than 25%. Portfolio P has an expected return that is less than 12%. Portfolio P has an expected return that is greater than 12%. Portfolio P has a coefficient of variation that is less than 2.1. Stock A's beta is 1.5 and Stock B's beta is 0.5. Which of the following statements must be true, assuming the CAPM is correct. If you invest % 50,000 in Stock A and $50,000 in Stock B, your 2-stock portfolio would have a beta significantly lower than 1.0. In equilibrium, the expected return on Stock A will be greater than that on Stock B. When held is isolation, Stock A has more risk than Stock B. Stock B's realized return during the coming year will be higher than Stock A's return. Stock A's return has a higher standard deviation than Stock B. Carson Inc.'s manger believes that economic conditions during the next year will be strong, normal, or weak, and she thinks that the firms' returns will have the probability distribution shown below. What's the coefficient of variation on the firm's returns? Economic Probability Stocks Conditions of States Return Strong 30% 32.0% Normal 40% 10.0% Weak 30% -16.0% 3.3 2.9 2.4 2.1 1.8 Other things held constant, if the expected inflation rate decreases and investors also become more risk averse, the Security Market Line (SML) would be affected as follows: The y-axis intercept would decline, and the slope would increase. The x-axis intercept would decline, and the slope would increase. The y-axis intercept would increase, and the slope would decline. The SML would be affected only if betas changed. Both the y-axis intercept and the slope would increase, leading to higher required returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts