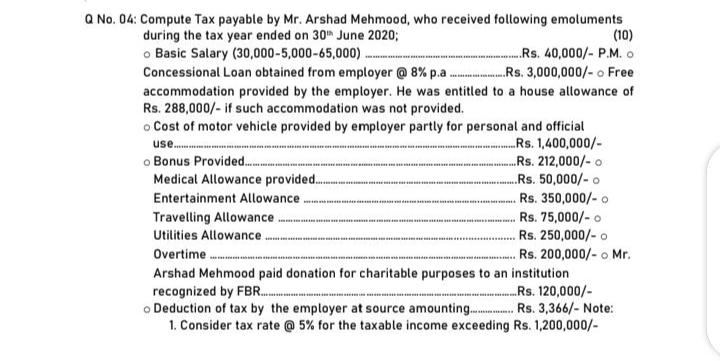

Question: Q No. 04: Compute Tax payable by Mr. Arshad Mehmood, who received following emoluments (10) Rs. 40,000/- P.M. o Rs. 3,000,000/- o Free during

Q No. 04: Compute Tax payable by Mr. Arshad Mehmood, who received following emoluments (10) Rs. 40,000/- P.M. o Rs. 3,000,000/- o Free during the tax year ended on 30h June 2020; o Basic Salary (30,000-5,000-65,000) . Concessional Loan obtained from employer @ 8% p.a. accommodation provided by the employer. He was entitled to a house allowance of Rs. 288,000/- if such accommodation was not provided. o Cost of motor vehicle provided by employer partly for personal and official use. o Bonus Provided. Rs. 1,400,000/- Rs. 212,000/- o Rs. 50,000/- o Medical Allowance provided. Entertainment Allowance. Rs. 350,000/- o Rs. 75,000/- o Travelling Allowance Utilities Allowance. Rs. 250,000/- o Overtime .Rs. 200,000/- o Mr. Arshad Mehmood paid donation for charitable purposes to an institution Rs. 120,000/- recognized by FBR. o Deduction of tax by the employer at source amounting. Rs. 3,366/- Note: 1. Consider tax rate @ 5% for the taxable income exceeding Rs. 1,200,000/-

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Answer MrArshad Mehmood has to pay a tax of Rs15184 on the taxable income of Rs1571000 Explanation S... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

636783b9440ae_240955.pdf

180 KBs PDF File

636783b9440ae_240955.docx

120 KBs Word File