Question: give me the true false question answer meaning and write T (TRUE) or F (FALSE) in the blank 1. Timing is not a particularly important

give me the true false question answer

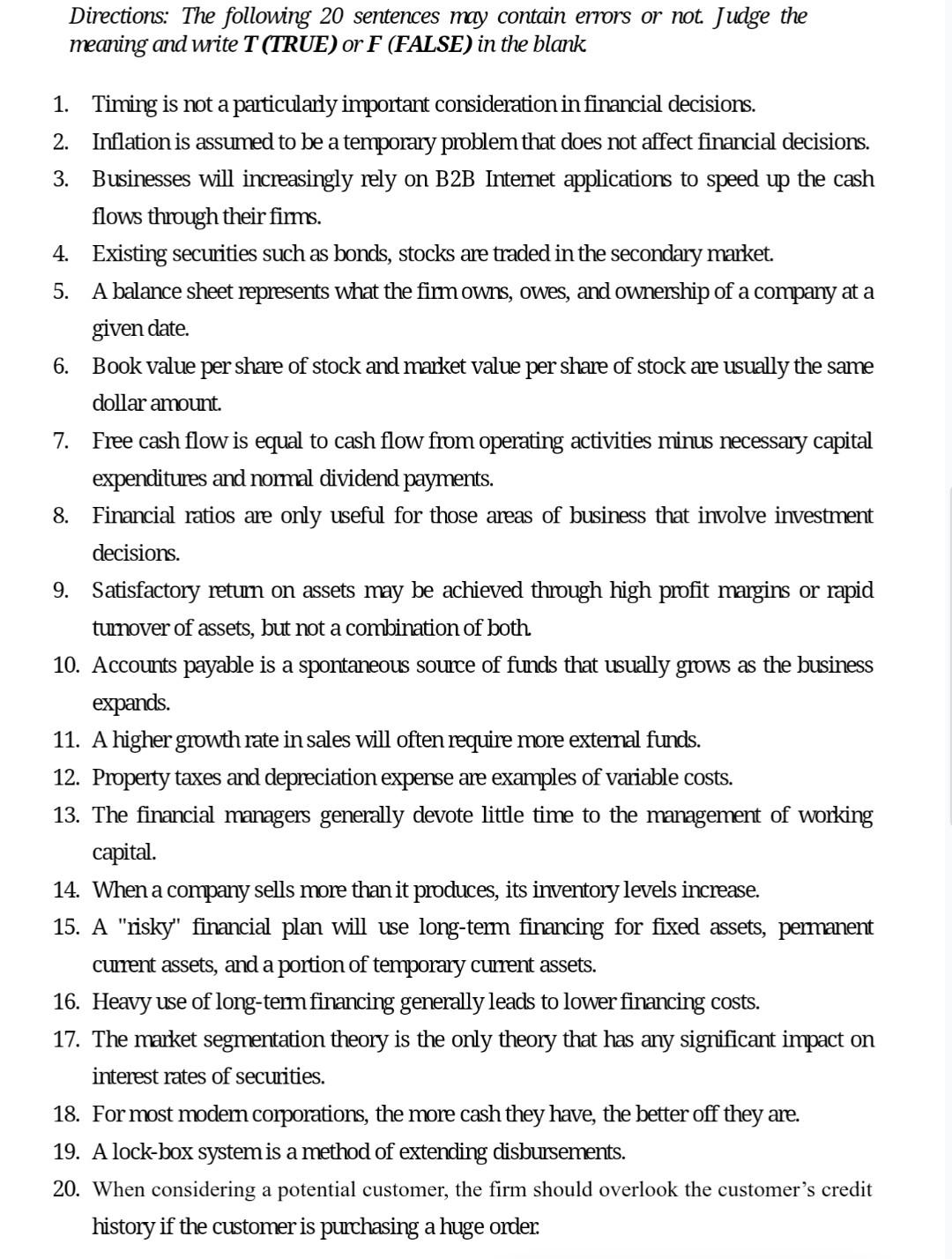

meaning and write T (TRUE) or F (FALSE) in the blank 1. Timing is not a particularly important consideration in financial decisions. 2. Inflation is assumed to be a temporary problem that does not affect financial decisions. 3. Businesses will increasingly rely on B2B Intemet applications to speed up the cash flows through their firms. 4. Existing securities such as bonds, stocks are traded in the secondary market. 5. A balance sheet represents what the firm owns, owes, and ownership of a company at a given date. 6. Book value per share of stock and market value per share of stock are usually the same dollar amount. 7. Free cash flow is equal to cash flow from operating activities minus necessary capital expenditures and normal dividend payments. 8. Financial ratios are only useful for those areas of business that involve investment decisions. 9. Satisfactory retum on assets may be achieved through high profit margins or rapid turnover of assets, but not a combination of both 10. Accounts payable is a spontaneous source of funds that usually grows as the business expands. 11. A higher growth rate in sales will often require more extemal funds. 12. Property taxes and depreciation expense are examples of variable costs. 13. The financial managers generally devote little time to the management of working capital. 14. When a company sells more than it produces, its inventory levels increase. 15. A "risky" financial plan will use long-term financing for fixed assets, permanent current assets, and a portion of temporary current assets. 16. Heavy use of long-term financing generally leads to lower financing costs. 17. The market segmentation theory is the only theory that has any significant impact on interest rates of securities. 18. For most modem corporations, the more cash they have, the better off they are. 19. A lock-box system is a method of extending disbursements. 20. When considering a potential customer, the firm should overlook the customer's credit history if the customer is purchasing a huge order

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts