Question: Give me these answer in table Crane Arrow Ltd . purchased a new bus on October 1 , 2 0 2 4 , at a

Give me these answer in table

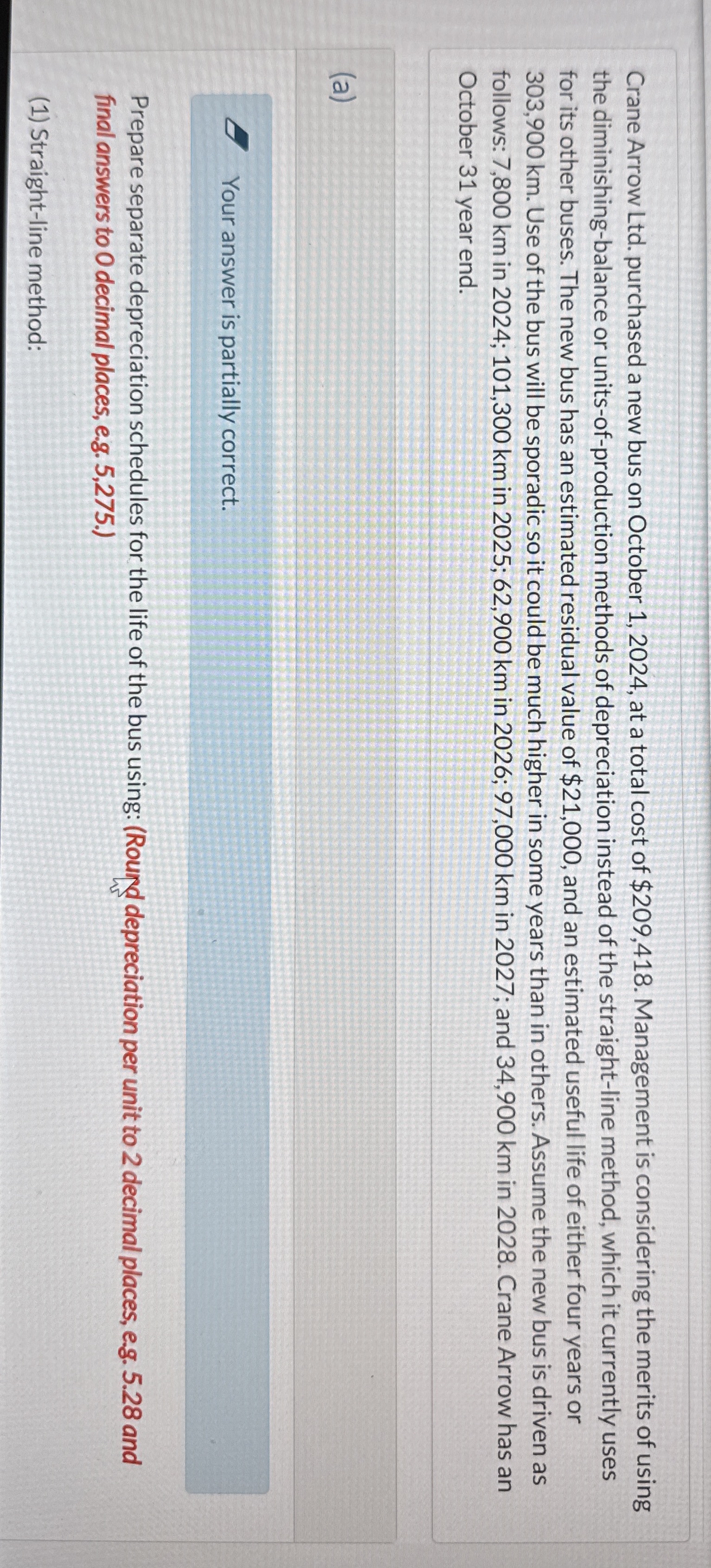

Crane Arrow Ltd purchased a new bus on October at a total cost of $ Management is considering the merits of using the diminishingbalance or unitsofproduction methods of depreciation instead of the straightline method, which it currently uses for its other buses. The new bus has an estimated residual value of $ and an estimated useful life of either four years or Use of the bus will be sporadic so it could be much higher in some years than in others. Assume the new bus is driven as follows: in ; km in ; in ; in ; and in Crane Arrow has an October year end.

a

Your answer is partially correct.

Prepare separate depreciation schedules for the life of the bus using: Rourd depreciation per unit to decimal places, eg and final answers to decimal places, eg

Straightline method:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock