Question: give Q2 correct answer in 10 mins i will give thumb up Suppose that PO is the price of a stock today and P1 its

give Q2 correct answer in 10 mins i will give thumb up

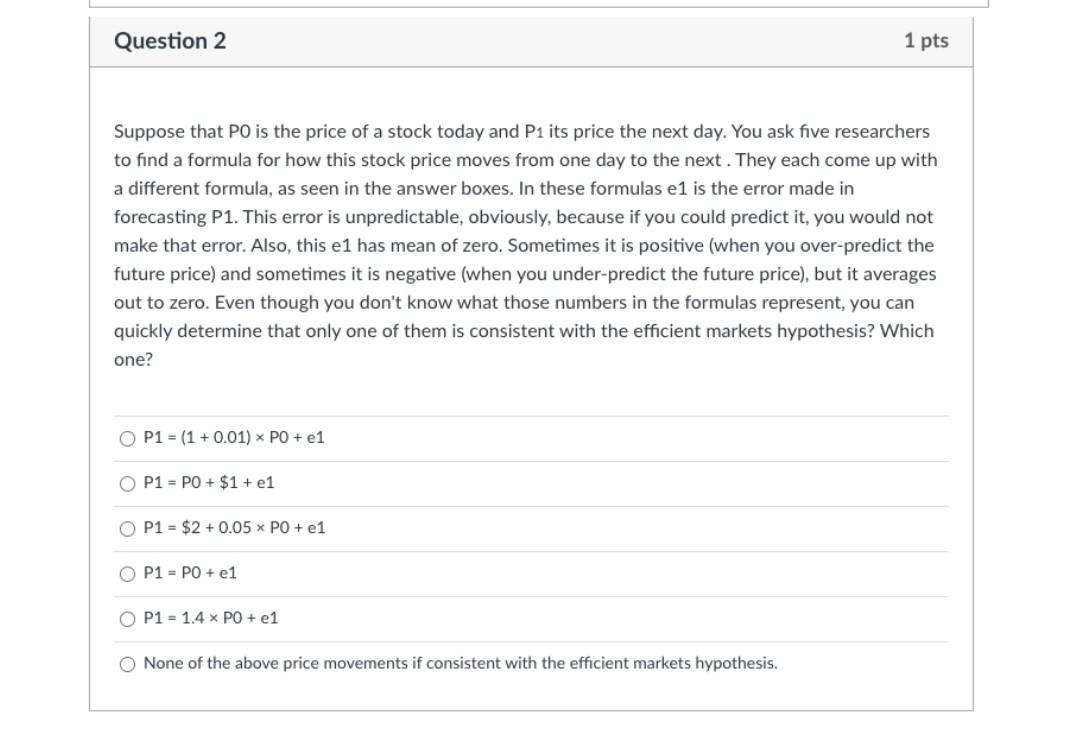

Suppose that PO is the price of a stock today and P1 its price the next day. You ask five researchers to find a formula for how this stock price moves from one day to the next. They each come up with a different formula, as seen in the answer boxes. In these formulas e 1 is the error made in forecasting P1. This error is unpredictable, obviously, because if you could predict it, you would not make that error. Also, this e1 has mean of zero. Sometimes it is positive (when you over-predict the future price) and sometimes it is negative (when you under-predict the future price), but it averages out to zero. Even though you don't know what those numbers in the formulas represent, you can quickly determine that only one of them is consistent with the efficient markets hypothesis? Which one? P1=(1+0.01)P0+e1P1=P0+$1+e1P1=$2+0.05P0+e1P1=P0+e1P1=1.4P0+e1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts