Question: give Q20 correct answer in 10 mins i will give thumb up During 1970 s the inflation rate was quite volatile due to the volatility

give Q20 correct answer in 10 mins i will give thumb up

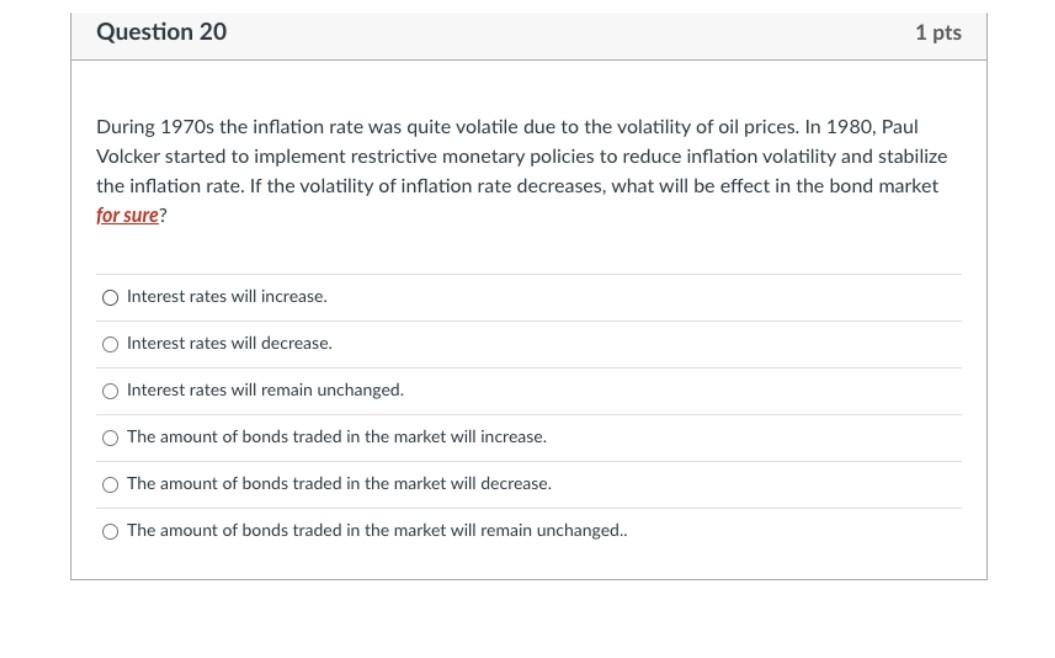

During 1970 s the inflation rate was quite volatile due to the volatility of oil prices. In 1980, Paul Volcker started to implement restrictive monetary policies to reduce inflation volatility and stabilize the inflation rate. If the volatility of inflation rate decreases, what will be effect in the bond market for sure? Interest rates will increase. Interest rates will decrease. Interest rates will remain unchanged. The amount of bonds traded in the market will increase. The amount of bonds traded in the market will decrease. The amount of bonds traded in the market will remain unchanged

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts