Question: Give the following information. Please answer step by step. Cherry, a fund manager, is making recommendations to her clients, Ben. Cherry is considering whether to

Give the following information. Please answer step by step.

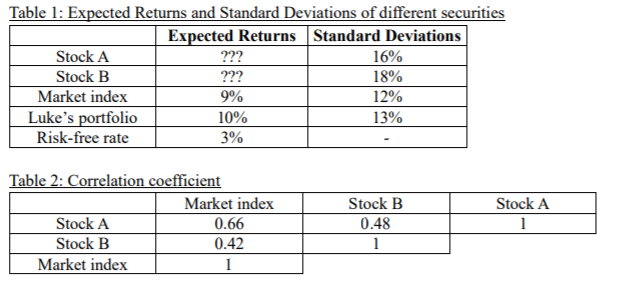

Cherry, a fund manager, is making recommendations to her clients, Ben. Cherry is considering whether to add Stock A or B into Bens well-diversified portfolio. She has made the following estimates:

(a) Describe briefly how diversification effect reduces portfolio risk. (4 marks)

(b) Compute expected returns of Stock A and Stock B respectively by using CAPM.

(c) Identify and explain whether Stock A or Stock B should be added in Bens portfolio for minimizing risk.

(d) Statement A: If the assumptions in CAPM are held, reward-to-risk ratios of all securities are the same. Therefore, all people should adopt passive management in investment. Statement B: All investors should invest in market portfolio only, as it is the best portfolio in the financial market. Do you agree to these two statements? Explain.

Table 1: Expected Returns and Standard Deviations of different securities Expected Returns Standard Deviations Stock A ??? 16% Stock B ??? 18% Market index 9% 12% Luke's portfolio 10% 13% Risk-free rate 3% Table 2: Correlation coefficient Market index Stock A 0.66 Stock B 0.42 Market index 1 Stock B 0.48 1 Stock A 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts