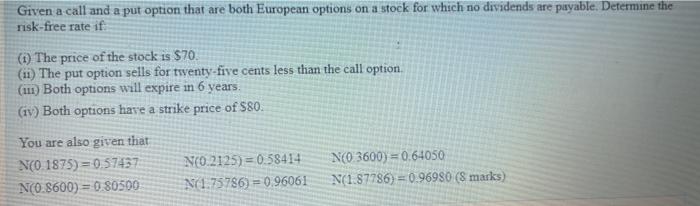

Question: Given a call and a put option that are both European options on a stock for which no dividends are payable. Determine the risk-free rate

Given a call and a put option that are both European options on a stock for which no dividends are payable. Determine the risk-free rate if (1) The price of the stock is $70. (ii) The put option sells for twenty-five cents less than the call option (111) Both options will expire in 6 years, (1) Both options have a strike price of $80. You are also given that NO 1875) = 0.57437 NO.2125) = 0.58414 NCO 3600) = 0.64050 N(0.8600) = 0.80500 N(1.75786) = 0.96061 N(1.87786) = 0.96980 (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts