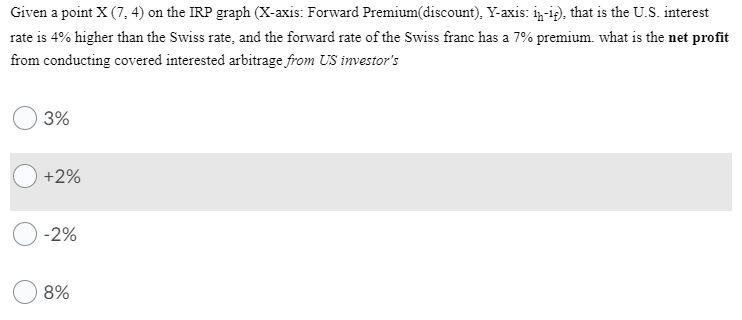

Question: Given a point X (7. 4) on the IRP graph (X-axis: Forward Premium(discount). Y-axis: 14-17)that is the U.S. interest rate is 4% higher than the

Given a point X (7. 4) on the IRP graph (X-axis: Forward Premium(discount). Y-axis: 14-17)that is the U.S. interest rate is 4% higher than the Swiss rate, and the forward rate of the Swiss franc has a 7% premium what is the net profit from conducting covered interested arbitrage from US investor's 3% +2% -2% 8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts