Question: GIVEN ABOUT THE MARKET: - T-bill return is 3.9% annually. - The expected annual return on the market portfolio equals 11%. GIVEN ABOUT THE GAMMA

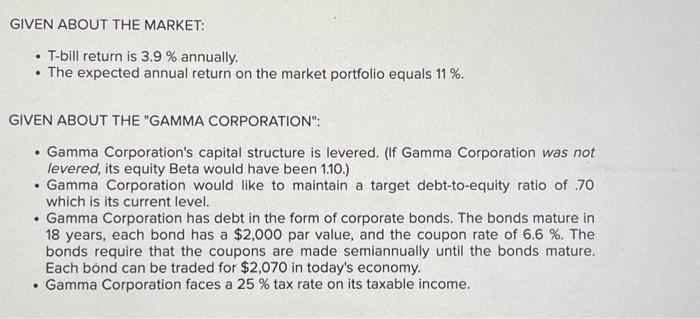

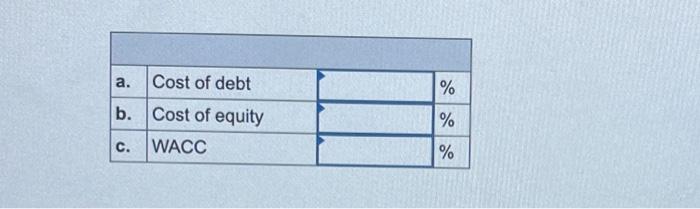

GIVEN ABOUT THE MARKET: - T-bill return is 3.9% annually. - The expected annual return on the market portfolio equals 11%. GIVEN ABOUT THE "GAMMA CORPORATION": - Gamma Corporation's capital structure is levered. (If Gamma Corporation was not levered, its equity Beta would have been 1.10.) - Gamma Corporation would like to maintain a target debt-to-equity ratio of .70 which is its current level. - Gamma Corporation has debt in the form of corporate bonds. The bonds mature in 18 years, each bond has a $2,000 par value, and the coupon rate of 6.6%. The bonds require that the coupons are made semiannually until the bonds mature. Each bond can be traded for \$2,070 in today's economy. - Gamma Corporation faces a 25% tax rate on its taxable income. \begin{tabular}{|l|l|l|l|} \hline \multicolumn{2}{|l|}{} & \\ \hline a. & Cost of debt & & % \\ \hline b. & Cost of equity & & % \\ \hline c. & WACC & & % \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts