Question: Given Acquisition Costs for each segment, is it profitable for Republic Wireless to acquire new customers for each segment? Briefly explain why or why

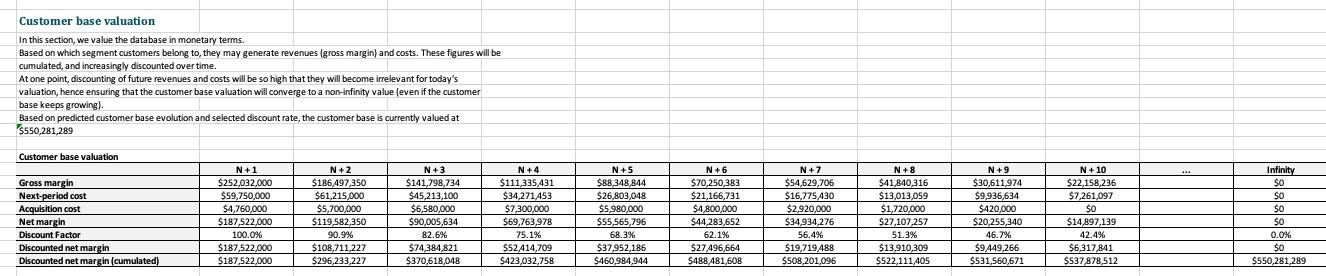

Given Acquisition Costs for each segment, is it profitable for Republic Wireless to acquire new customers for each segment? Briefly explain why or why not for each segment. Note: for this question, compare the Acquisition Costs to the Cumulative Net Margin (Discounted) for each segment at N+10. Customer base valuation In this section, we value the database in monetary terms. Based on which segment customers belong to, they may generate revenues (gross margin) and costs. These figures will be cumulated, and increasingly discounted over time. At one point, discounting of future revenues and costs will be so high that they will become irrelevant for today's valuation, hence ensuring that the customer base valuation will converge to a non-infinity value (even if the customer base keeps growing). Based on predicted customer base evolution and selected discount rate, the customer base is currently valued at $550,281,289 Customer base valuation Gross margin Next-period cost Acquisition cost Net margin Discount Factor Discounted net margin Discounted net margin (cumulated) N+1 $252,032,000 $59,750,000 $4,760,000 $187,522,000 100.0% $187,522,000 $187,522,000 N+2 $186,497,350 $61,215,000 $5,700,000 $119,582,350 90.9% $108,711,227 $296,233,227 N+3 $141.798.734 $45,213,100 $6,580,000 $90,005,634 82.6% $74,384,821 $370,618,048 N +4 $111,335,431 $34,271,453 $7,300,000 $69,763,978 75.1% $52,414,709 $423,032,758 N+5 $88,348,844 $26,803,048 $5,980,000 $55,565,796 68.3% $37,952,186 $460,984,944 N+6 $70,250.383 $21,166,731 $4,800,000 $44,283,652 62.1% $27,496,664 $488,481,608 N+7 $54,629,706 $16,775,430 $2,920,000 $34,934,276 56.4% $19,719,488 $508,201,096 N+8 $41,840.316 $13,013,059 $1,720,000 $27,107,257 51.3% $13,910,309 $522,111,405 N +9 $30,611.974 $9,936,634 $420,000 $20,255,340 46.7% $9,449,266 $531,560,671 N + 10 $22.158,236 $7,261,097 $0 $14,897,139 42.4% $6,317,841 $537,878,512 Infinity $0 $0 $0 $0 0.0% $0 $550,281,289

Step by Step Solution

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Analysis of the Given Data Key Points Acquisition Costs and Cumulative Net Margin Discounted for eac... View full answer

Get step-by-step solutions from verified subject matter experts