Question: Given an optimal risky portfolio with expected return 15%, standard deviation 30%, and risk-free rate 4%: (a) What is the slope of the CAL? (b)

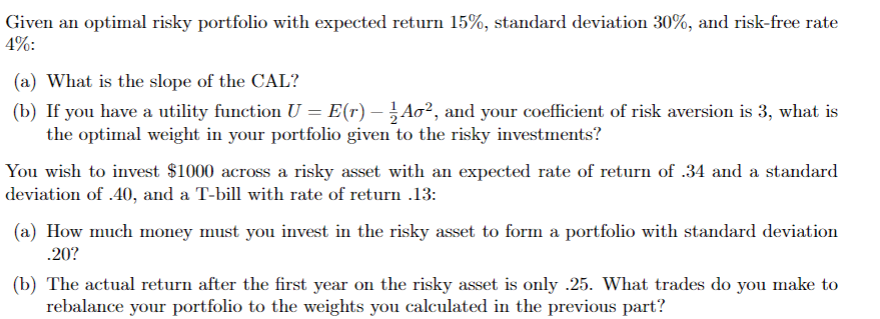

Given an optimal risky portfolio with expected return 15%, standard deviation 30%, and risk-free rate 4%: (a) What is the slope of the CAL? (b) If you have a utility function U = E(r) Ao2, and your coefficient of risk aversion is 3, what is the optimal weight in your portfolio given to the risky investments? You wish to invest $1000 across a risky asset with an expected rate of return of 34 and a standard deviation of .40, and a T-bill with rate of return .13: (a) How much money must you invest in the risky asset to form a portfolio with standard deviation 20? (b) The actual return after the first year on the risky asset is only .25. What trades do you make to rebalance your portfolio to the weights you calculated in the previous part

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts