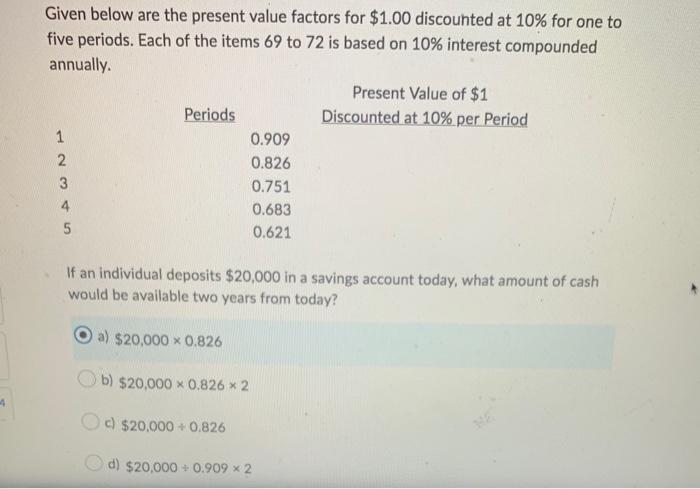

Question: Given below are the present value factors for $1.00 discounted at 10% for one to five periods. Each of the items 69 to 72

Given below are the present value factors for $1.00 discounted at 10% for one to five periods. Each of the items 69 to 72 is based on 10% interest compounded annually. Present Value of $1 Periods Discounted at 10% per Period 1 0.909 0.826 0.751 0.683 0.621 If an individual deposits $20,000 in a savings account today, what amount of cash would be available two years from today? a) $20,000 x 0.826 b) $20,000 x 0.826 x 2 c) $20,000 + 0.826 d) $20,000 + 0.909 x 2 For which of the following transactions would the use of the present value of an ordinary annuity concept be appropriate in calculating the present value of the asset obtained or the liability owed at the date of incurrence? a) A capital lease is entered into with the initial lease payment due one month subsequent to the signing of the lease agreement. O b) A capital lease is entered into with the initial lease payment due upon the b) signing of the lease agreement. c) A ten-year 8% bond is issued on January 2 with interest payable semiannually on January 2 and July 1 yielding 7%. d) A ten-year 8% bond is issued on January 2 with interest payable semiannually on January 2 and July 1 yielding 9%. Which of the following is FALSE about bonds issued at a DISCOUNT? a) The bonds are issued for an amount under its par value. The book value (carrying value) of the bonds will decrease after each O b) interest period c) At maturity, the book value and the face amount will be equal. 15 d) At the time bonds were issued the market interest rate was higher than the coupon rate of interest stated on the bond 18

Step by Step Solution

There are 3 Steps involved in it

Question 1 Answer c 20000 0826 Explanations In the given table the discounting factors for 10 intere... View full answer

Get step-by-step solutions from verified subject matter experts