Question: Given below are three ratios calculated for three companies for the years 2011 and 2012. Dobson Co. Larson Co. Hawkins Co. Dec 31 1.8 2.2

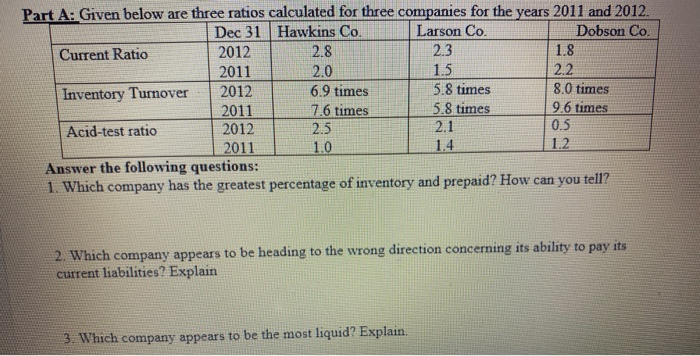

Part A: Given below are three ratios calculated for three companies for the years 2011 and 2012. Dec 31 Hawkins Co. Larson Co. Dobson Co. Current Ratio 2012 2.8 2.3 1.8 2011 2.0 1.5 2.2 Inventory Turnover 2012 6.9 times 5.8 times 8.0 times 2011 7.6 times 5.8 times 9.6 times Acid-test ratio 2012 2.5 2.1 2011 1.0 1.4 1.2 Answer the following questions: 1. Which company has the greatest percentage of inventory and prepaid? How can you tell? 0.5 2. Which company appears to be heading to the wrong direction concerning its ability to pay its current liabilities? Explain 3. Which company appears to be the most liquid? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts