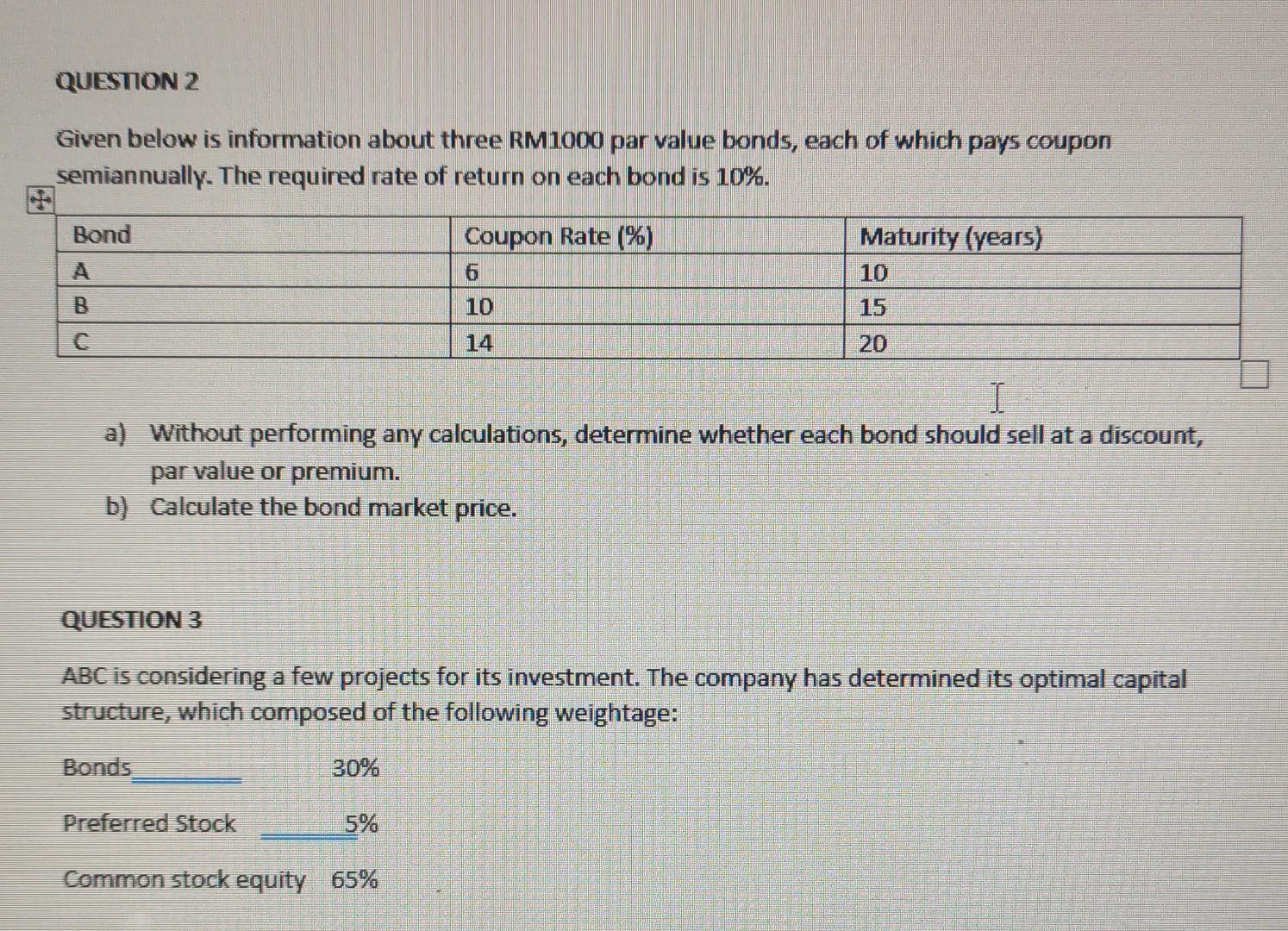

Question: Given below is information about three RM1000 par value bonds, each of which pays coupon semiannually. The required rate of return on each bond is

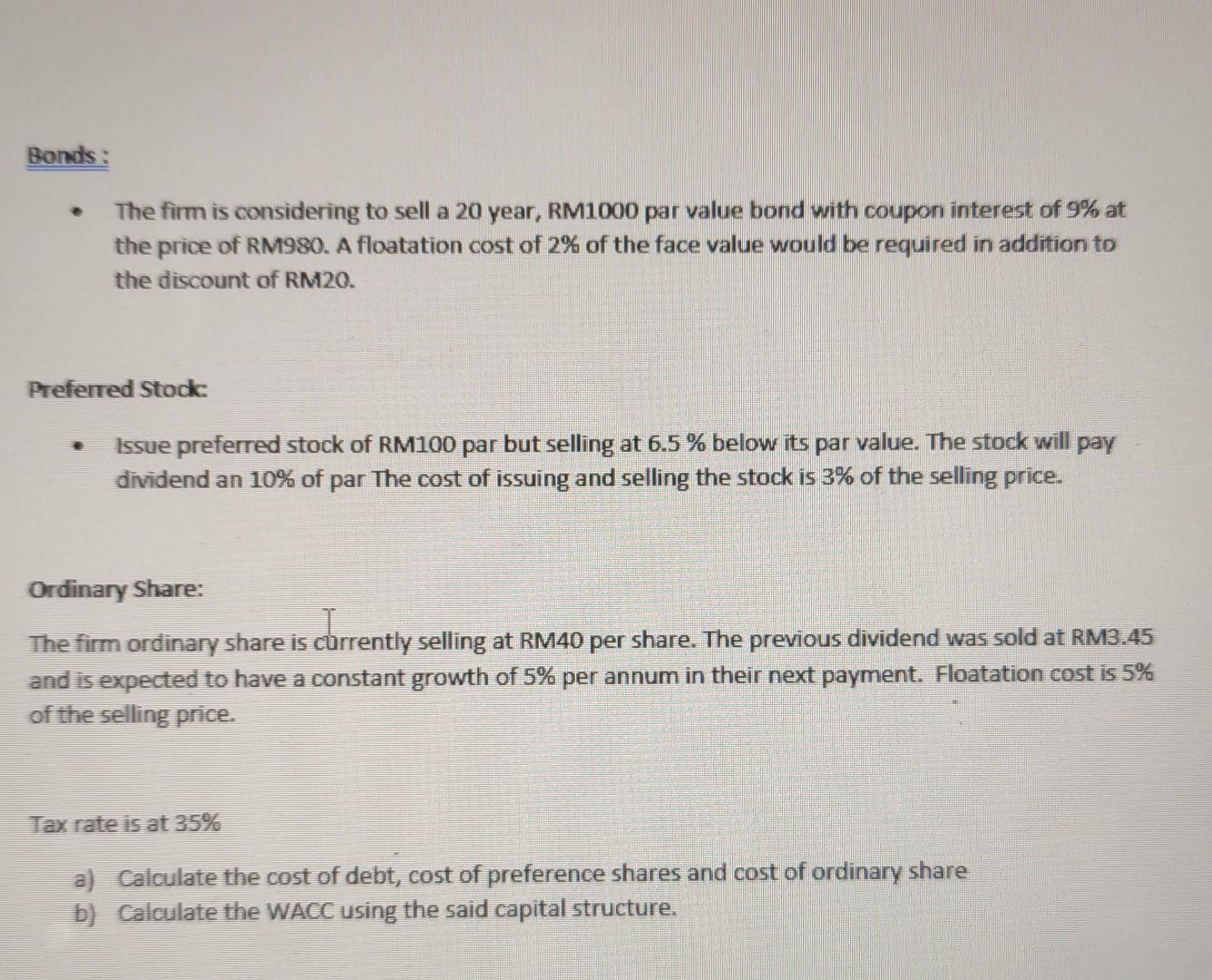

Given below is information about three RM1000 par value bonds, each of which pays coupon semiannually. The required rate of return on each bond is 10%. a) Without performing any calculations, determine whether each bond should sell at a discount, par value or premium. b) Calculate the bond market price. QUESTION 3 ABC is considering a few projects for its investment. The company has determined its optimal capital structure, which composed of the following weightage: Bonds 30% Preferred Stock Common stock equity 65% Bonds: - The firm is considering to sell a 20 year, RM1000 par value bond with coupon interest of 9% at the price of RM980. A floatation cost of 2% of the face value would be required in addition to the discount of RM20. Preferred Stock: - Issue preferred stock of RM100 par but selling at 6.5% below its par value. The stock will pay dividend an 10% of par The cost of issuing and selling the stock is 3% of the selling price. Ordinary Share: The firm ordinary share is currently selling at RM40 per share. The previous dividend was sold at RM3.45 and is expected to have a constant growth of 5% per annum in their next payment. Floatation cost is 5% of the selling price. Tax rate is at 35% a) Calculate the cost of debt, cost of preference shares and cost of ordinary share b) Calculate the WACC using the said capital structure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts