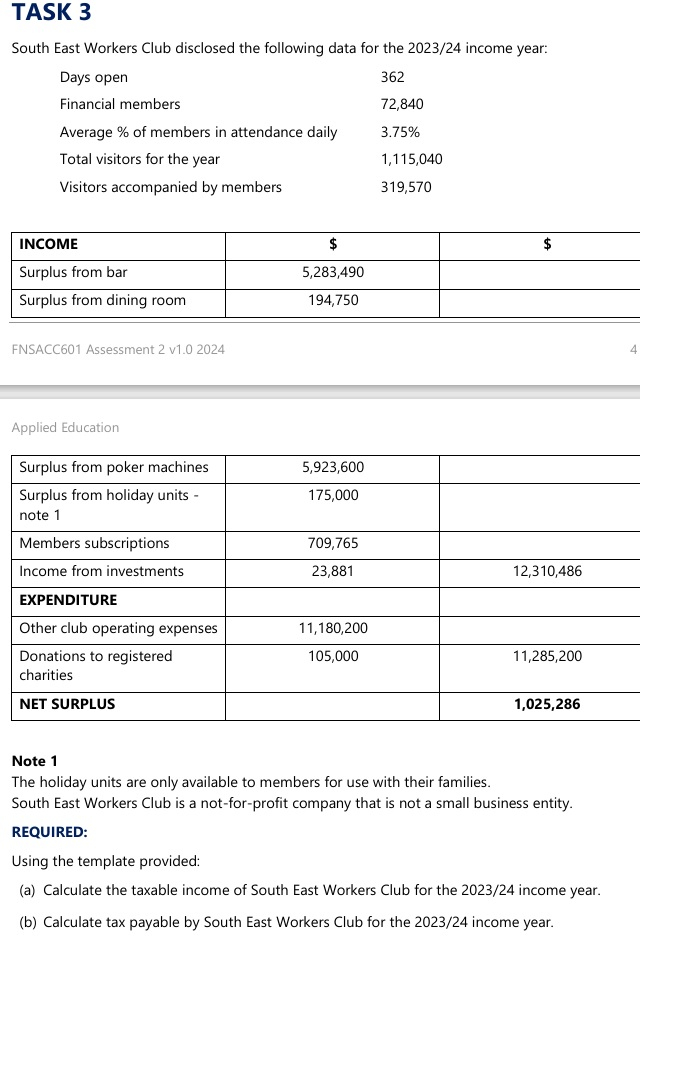

Question: Given below is the task details. TASK 3 South East Workers Club disclosed the following data for the 2 0 2 3 / 2 4

Given below is the task details. TASK South East Workers Club disclosed the following data for the income year: Applied Education Surplus from holiday units note Donations to registered charities Note The holiday units are only available to members for use with their families. South East Workers Club is a notforprofit company that is not a small business entity. REQUIRED: Using the template provided: a Calculate the taxable income of South East Workers Club for the income year. b Calculate tax payable by South East Workers Club for the income year. I need answers on given Questions. Q : Proportion of receipts deemed to be from members Show your workings here: Answer in Percentage Q : Taxable Income: Assessable Income? Q : Taxable Income? Q : Tax Payable

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock