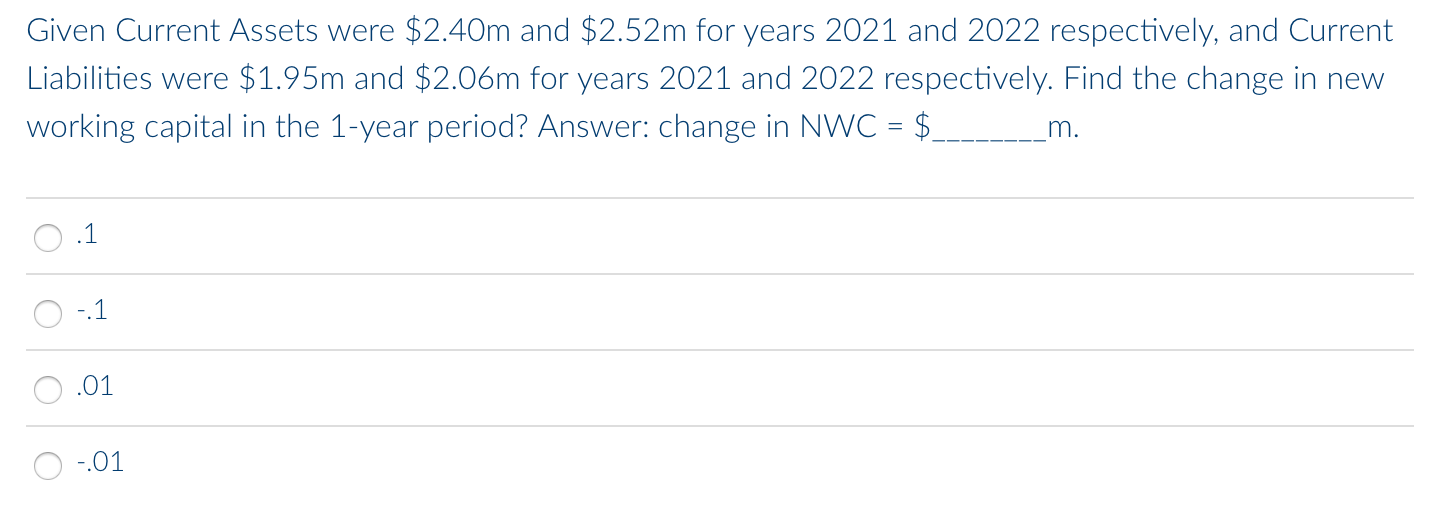

Question: Given Current Assets were $2.40m and $2.52m for years 2021 and 2022 respectively, and Current Liabilities were $1.95m and $2.06m for years 2021 and 2022

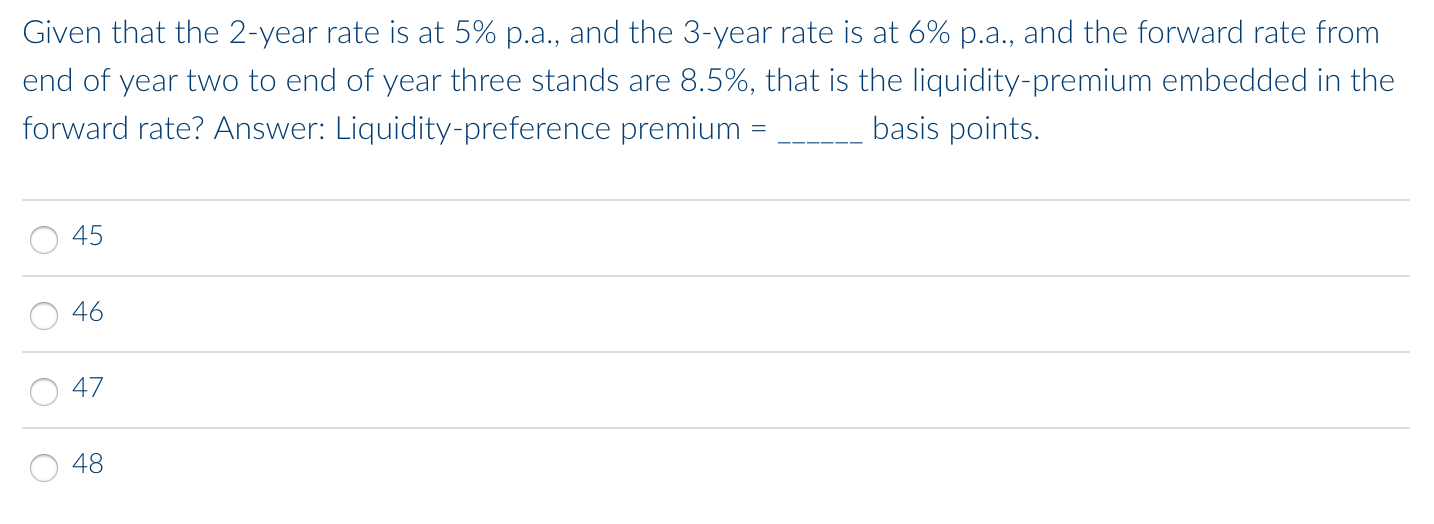

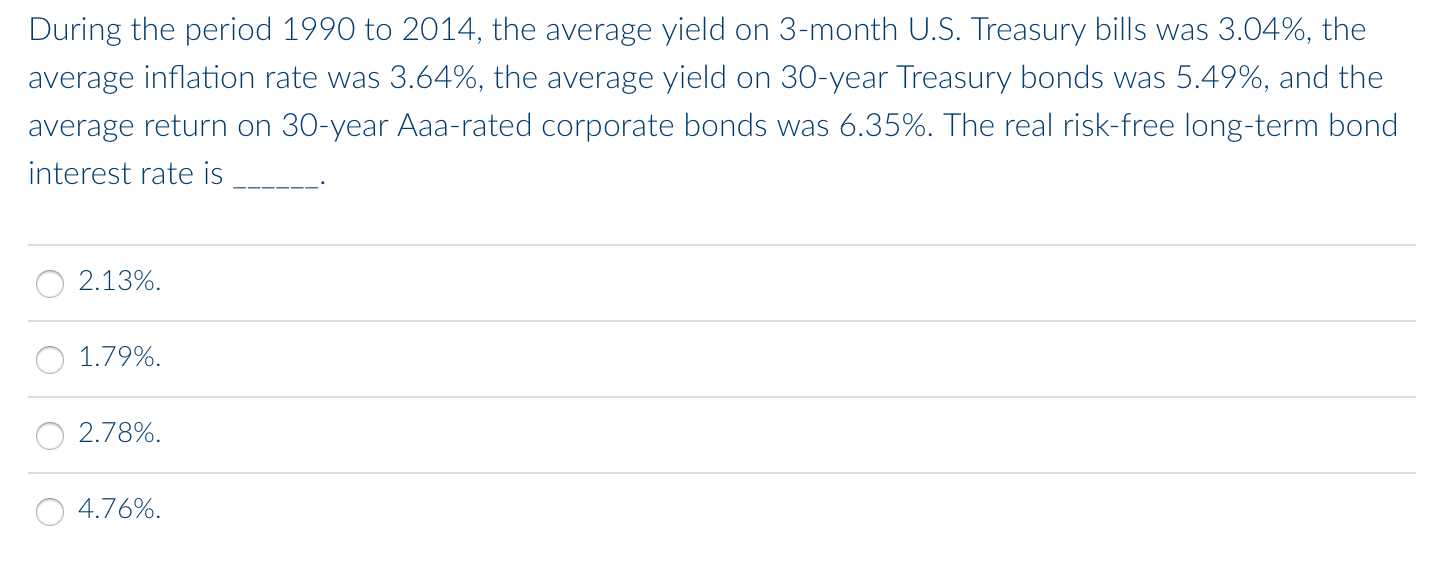

Given Current Assets were $2.40m and $2.52m for years 2021 and 2022 respectively, and Current Liabilities were $1.95m and $2.06m for years 2021 and 2022 respectively. Find the change in new working capital in the 1-year period? Answer: change in NWC = $. m. .1 -1 .01 -.01 Given that the 2-year rate is at 5% p.a., and the 3-year rate is at 6% p.a., and the forward rate from end of year two to end of year three stands are 8.5%, that is the liquidity-premium embedded in the forward rate? Answer: Liquidity-preference premium basis points. 45 o 46 47 O 48 O During the period 1990 to 2014, the average yield on 3-month U.S. Treasury bills was 3.04%, the average inflation rate was 3.64%, the average yield on 30-year Treasury bonds was 5.49%, and the average return on 30-year Aaa-rated corporate bonds was 6.35%. The real risk-free long-term bond interest rate is 2.13%. 1.79%. 2.78%. 4.76%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts