Question: Given data for company- Option 2 The second option is to purchase and operate a factory in Knoxville, Tennessee which would double Humble Pies current

Given data for company-

Option 2

The second option is to purchase and operate a factory in Knoxville, Tennessee which would double Humble Pies current production volume. There is an existing food production facility in Knoxville in a location that is well positioned on distribution routes and provides proximity to a whole new market of restaurants and grocery chains. The asking price for the factory is $7.5 million and includes existing equipment. About half the machinery could be used by Humble Pies but would also require an investment of $2.5 million in additional equipment with a 10 year average life to provide the same capacity as the current factory. It would take about six months to get the new plant up and running. Estimated sales for the first three years after it opens are $4 million, $6 million and $10 million, respectively. Variable expenses are expected to have about the same behavior and relationship to sales as the current facility. Fixed\expenses would be about the same amount per month as the current factory.

2. Assess the viability and profitability for the Knoxville factory including its expected ROI and residual income. What does this analysis suggest for Humble Pies?

(I do not NEED to solve for residual income, but I need to figure out ROI. I don't know how to go from sales to net operating income so that I can solve for ROI. I dont even know where to start please help. This is from Linda's Pies case study from the AICPA--part 3)

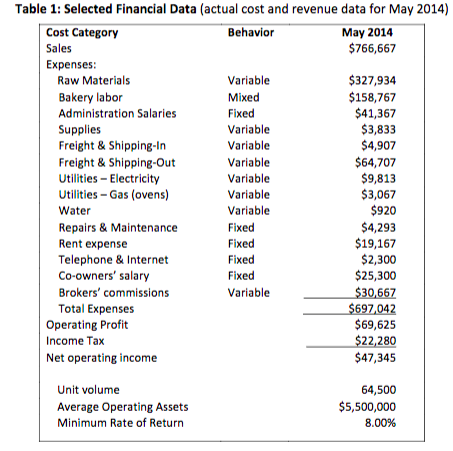

Table 1: Selected Financial Data (actual cost and revenue data for May 2014) Behavior Cost Category Sales Expenses May 2014 $766,667 Raw Materials Bakery labor Administration Salaries Supplies Freight &Shipping-In Freight &Shipping-Out Utilities Electricity Utilities- Gas (ovens) Water Repairs & Maintenance Rent expense Telephone & Internet Co-owners' salary Brokers' commissions Total Expenses Variable Mixed Fixed Variable Variable Variable Variable Variable Variable Fixed Fixed Fixed Fixed Variable $327,934 $158,767 $41,367 3,833 $4,907 $64,707 9,813 3,067 $920 4,293 $19,167 $2,300 $25,300 Operating Profit Income Tax Net operating income $69,625 22,280 $47,345 Unit volume Average Operating Assets Minimum Rate of Return 64,500 $5,500,000 8.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts