Question: GIVEN DATA FOR PAN COMPANY: JTM Airlines, a privately held firm, is looking to buy additional gates at its home airport for $1,500,000. It has

GIVEN DATA FOR PAN COMPANY:

JTM Airlines, a privately held firm, is looking to buy additional gates at its home airport for $1,500,000. It has money in the bank, but that money may not be spent as it is used to pay salaries, suppliers, and equipment. It asked its bank for a loan, but the bank refused unless the project had a return higher than JTM's weighted average cost of capital. Separately, PAN Airways's CEO approached JTM's CEO to sell the airline. As a result of all this, JTM has contracted you to:

JTM Airlines, a privately held firm, is looking to buy additional gates at its home airport for $1,500,000. It has money in the bank, but that money may not be spent as it is used to pay salaries, suppliers, and equipment. It asked its bank for a loan, but the bank refused unless the project had a return higher than JTM's weighted average cost of capital. Separately, PAN Airways's CEO approached JTM's CEO to sell the airline. As a result of all this, JTM has contracted you to:

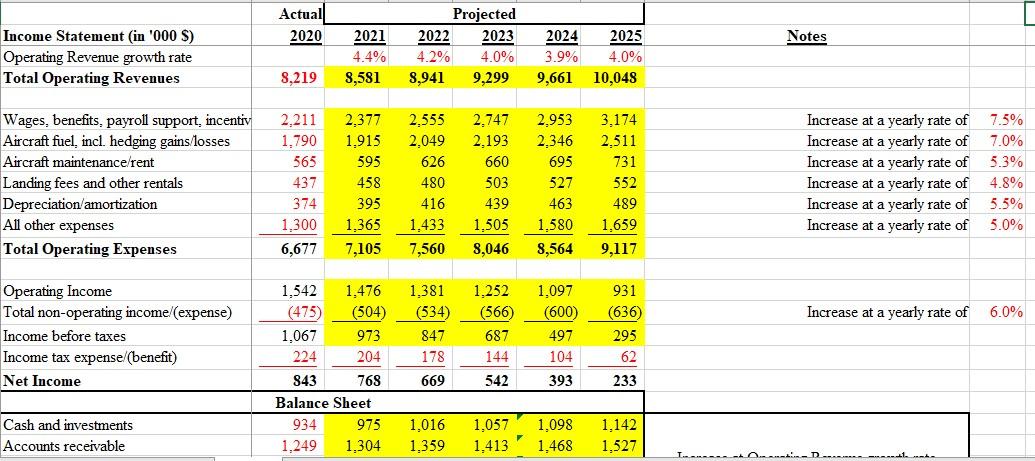

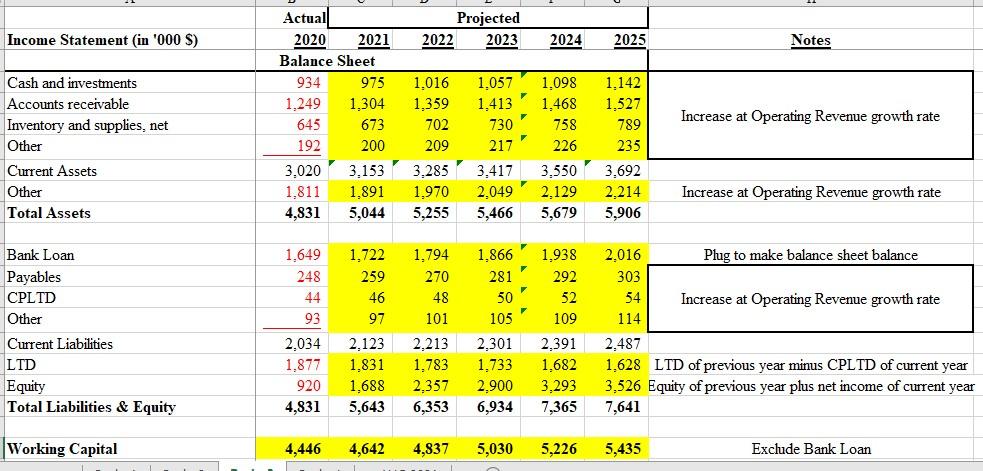

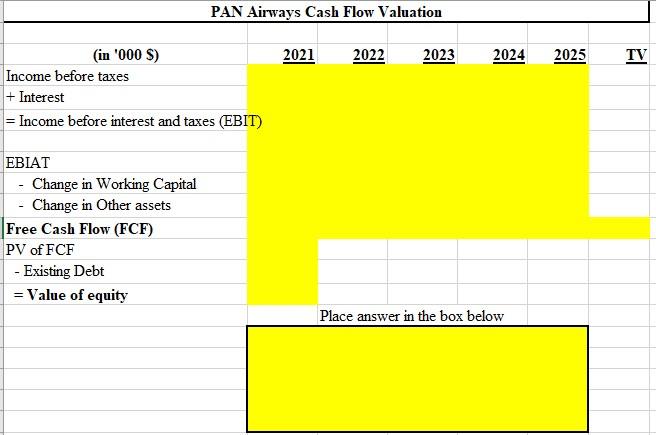

QUESTION: The price discussed by the two CEOs is $6.5M. You must value PAN Airways using free cash flows to see if this price is fair or not. ( COMPLETE THE BELOW WORKSHEET USING EXCEL BY USING THE DATA FROM FIRST TWO SHEET OF PAN COMPANY)

Actuall 2020 Notes Income Statement (in '000 S) Operating Revenue growth rate Total Operating Revenues 2021 4.4% 8,581 Projected 2022 2023 4.2% 4.0% 8,941 9,299 2024 3.9% 9,661 2025 4.0% 10,048 8,219 2.747 2,953 7.5% 7.0% 5.3% Wages, benefits, payroll support, incentiv Aircraft fuel, incl. hedging gains/losses Aircraft maintenance/rent Landing fees and other rentals Depreciation amortization All other expenses Total Operating Expenses 2,211 1.790 565 437 374 1,300 6,677 2.377 1,915 595 458 395 1,365 7,105 2,555 2,049 626 480 416 1.433 7,560 2.193 660 503 439 1,505 8,046 2.346 695 527 463 1,580 8,564 3,174 2.511 731 552 489 1,659 9,117 Increase at a yearly rate of Increase at a yearly rate of Increase at a yearly rate of Increase at a yearly rate of Increase at a yearly rate of Increase at a yearly rate of 4.8% 5.5% 5.0% Increase at a yearly rate of 6.0% Operating Income Total non-operating income (expense) Income before taxes Income tax expense (benefit) Net Income 1,542 1,476 (475) (504) 1,067 973 224 204 843 768 Balance Sheet 934 975 1,249 1,304 1.381 (534) 847 178 669 1,252 (566) 687 144 542 1.097 (600) 497 104 393 931 (636) 295 62 233 1,057 Cash and investments Accounts receivable 1,016 1.359 1,098 1,468 1.142 1,527 1,413 21 Income Statement (in '000 S) Projected 2022 2023 2021 2024 2025 Notes 1,057 1,413 Actual 2020 Balance Sheet 934 975 1,249 1,304 645 673 192 200 3,020 3.153 1,891 4,831 5,044 Increase at Operating Revenue growth rate Cash and investments Accounts receivable Inventory and supplies, net Other Current Assets Other Total Assets 730 1,016 1,359 702 209 3.285 1,970 5,255 217 1.098 1,468 758 226 3,550 2.129 5,679 1.142 1,527 789 235 3,692 2.214 5,906 1,811 3,417 2.049 5,466 Increase at Operating Revenue growth rate Bank Loan Payables CPLTD Other Current Liabilities LTD Equity Total Liabilities & Equity 1,649 248 44 93 2,034 1,877 920 4,831 1,722 259 46 97 2,123 1.831 1,688 5,643 1,794 270 48 101 2.213 1.783 2,357 6,353 1,866 281 50 105 2.301 1.733 2.900 6,934 1,938 292 52 109 2.391 1.682 3,293 7,365 2,016 Plug to make balance sheet balance 303 54 Increase at Operating Revenue growth rate 114 2,487 1,628 LTD of previous year minus CPLTD of current year 3,526 Equity of previous year plus net income of current year 7,641 Working Capital 4,446 4,642 4,837 5,030 5,226 5,435 Exclude Bank Loan PAN Airways Cash Flow Valuation 2021 2022 2023 2024 2025 TV (in '000 S) Income before taxes + Interest = Income before interest and taxes (EBIT) EBIAT Change in Working Capital Change in Other assets Free Cash Flow (FCF) PV of FCF - Existing Debt = Value of equity Place answer in the box below Actuall 2020 Notes Income Statement (in '000 S) Operating Revenue growth rate Total Operating Revenues 2021 4.4% 8,581 Projected 2022 2023 4.2% 4.0% 8,941 9,299 2024 3.9% 9,661 2025 4.0% 10,048 8,219 2.747 2,953 7.5% 7.0% 5.3% Wages, benefits, payroll support, incentiv Aircraft fuel, incl. hedging gains/losses Aircraft maintenance/rent Landing fees and other rentals Depreciation amortization All other expenses Total Operating Expenses 2,211 1.790 565 437 374 1,300 6,677 2.377 1,915 595 458 395 1,365 7,105 2,555 2,049 626 480 416 1.433 7,560 2.193 660 503 439 1,505 8,046 2.346 695 527 463 1,580 8,564 3,174 2.511 731 552 489 1,659 9,117 Increase at a yearly rate of Increase at a yearly rate of Increase at a yearly rate of Increase at a yearly rate of Increase at a yearly rate of Increase at a yearly rate of 4.8% 5.5% 5.0% Increase at a yearly rate of 6.0% Operating Income Total non-operating income (expense) Income before taxes Income tax expense (benefit) Net Income 1,542 1,476 (475) (504) 1,067 973 224 204 843 768 Balance Sheet 934 975 1,249 1,304 1.381 (534) 847 178 669 1,252 (566) 687 144 542 1.097 (600) 497 104 393 931 (636) 295 62 233 1,057 Cash and investments Accounts receivable 1,016 1.359 1,098 1,468 1.142 1,527 1,413 21 Income Statement (in '000 S) Projected 2022 2023 2021 2024 2025 Notes 1,057 1,413 Actual 2020 Balance Sheet 934 975 1,249 1,304 645 673 192 200 3,020 3.153 1,891 4,831 5,044 Increase at Operating Revenue growth rate Cash and investments Accounts receivable Inventory and supplies, net Other Current Assets Other Total Assets 730 1,016 1,359 702 209 3.285 1,970 5,255 217 1.098 1,468 758 226 3,550 2.129 5,679 1.142 1,527 789 235 3,692 2.214 5,906 1,811 3,417 2.049 5,466 Increase at Operating Revenue growth rate Bank Loan Payables CPLTD Other Current Liabilities LTD Equity Total Liabilities & Equity 1,649 248 44 93 2,034 1,877 920 4,831 1,722 259 46 97 2,123 1.831 1,688 5,643 1,794 270 48 101 2.213 1.783 2,357 6,353 1,866 281 50 105 2.301 1.733 2.900 6,934 1,938 292 52 109 2.391 1.682 3,293 7,365 2,016 Plug to make balance sheet balance 303 54 Increase at Operating Revenue growth rate 114 2,487 1,628 LTD of previous year minus CPLTD of current year 3,526 Equity of previous year plus net income of current year 7,641 Working Capital 4,446 4,642 4,837 5,030 5,226 5,435 Exclude Bank Loan PAN Airways Cash Flow Valuation 2021 2022 2023 2024 2025 TV (in '000 S) Income before taxes + Interest = Income before interest and taxes (EBIT) EBIAT Change in Working Capital Change in Other assets Free Cash Flow (FCF) PV of FCF - Existing Debt = Value of equity Place answer in the box below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts