Question: Given Data: Liam and Katano formed a partnership to open a sushi restaurant by investing S95,000 and $105,000, respectively. They agreed to share profit based

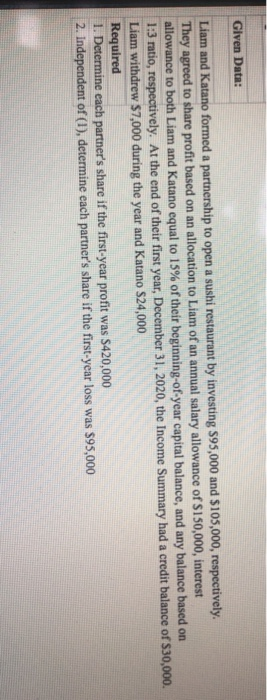

Given Data: Liam and Katano formed a partnership to open a sushi restaurant by investing S95,000 and $105,000, respectively. They agreed to share profit based on an allocation to Liam of an annual salary allowance of $150,000, interest allowance to both Liam and Katano equal to 15% of their beginning-of-year capital balance, and any balance based on 1:3 ratio, respectively. At the end of their first year, December 31, 2020, the Income Summary had a credit balance of $30,000. Liam withdrew $7,000 during the year and Katano S24,000 Required 1. Determine each partner's share if the first-year profit was $420,000 2. Independent of (I), determine each partner's share if the first-year loss was 595,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts