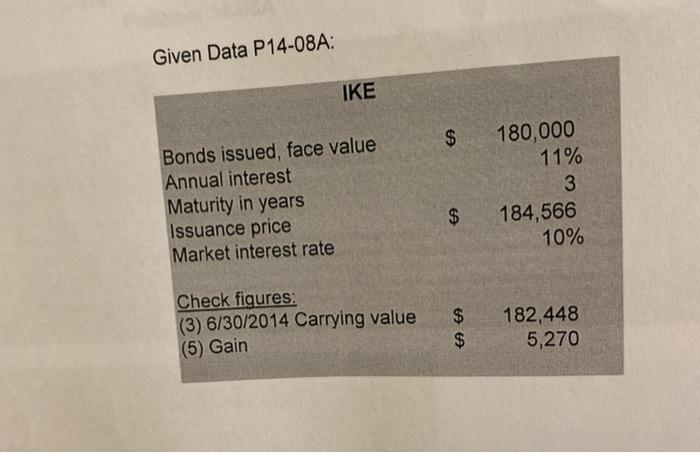

Question: Given Data P14-08A: IKE $ Bonds issued, face value Annual interest Maturity in years Issuance price Market interest rate 180,000 11% 3 184,566 10% $

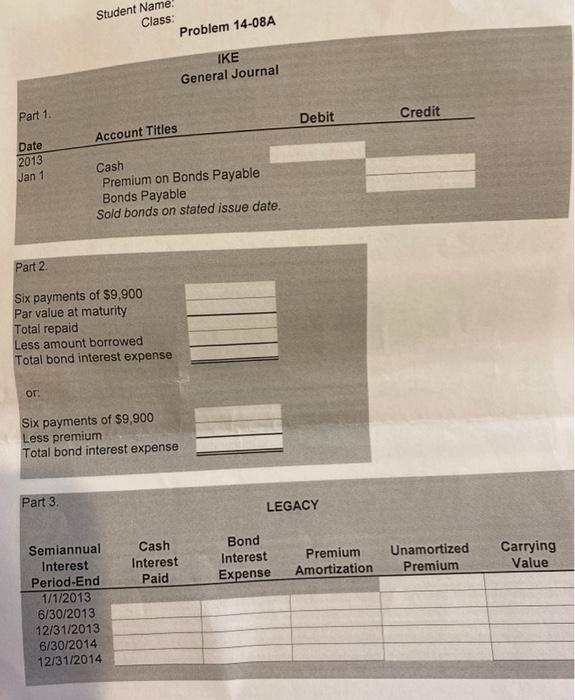

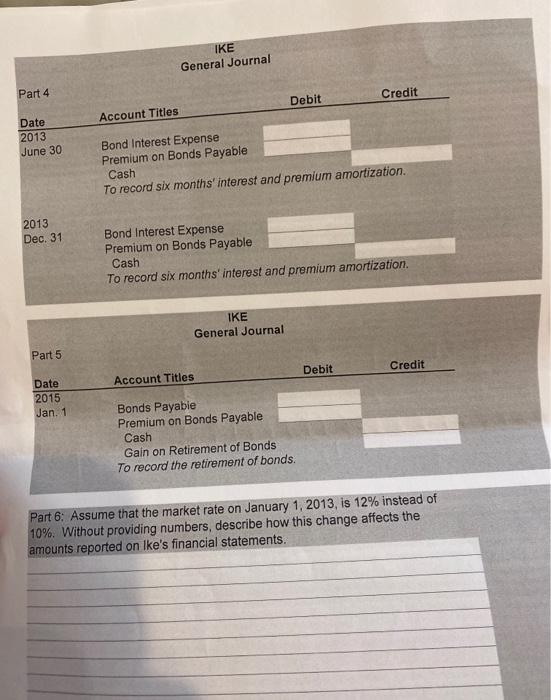

Given Data P14-08A: IKE $ Bonds issued, face value Annual interest Maturity in years Issuance price Market interest rate 180,000 11% 3 184,566 10% $ Check figures: (3) 6/30/2014 Carrying value $ $ 182,448 5,270 (5) Gain Student Name Class: Problem 14-08A IKE General Journal Part 1 Debit Credit Account Titles Date 2013 Jan 1 Cash Premium on Bonds Payable Bonds Payable Sold bonds on stated issue date. Part 2 Six payments of $9.900 Par value at maturity Total repaid Less amount borrowed Total bond interest expense or Six payments of $9.900 Less premium Total bond interest expense Part 3 LEGACY Cash Interest Paid Bond Interest Expense Premium Amortization Unamortized Premium Carrying Value Semiannual Interest Period-End 1/1/2013 6/30/2013 12/31/2013 6/30/2014 12/31/2014 IKE General Journal Part 4 Debit Credit Account Titles Date 2013 June 30 Bond Interest Expense Premium on Bonds Payable Cash To record six months' interest and premium amortization. 2013 Dec. 31 Bond Interest Expense Premium on Bonds Payable Cash To record six months' interest and premium amortization IKE General Journal Part 5 Debit Credit Account Titles Date 2015 Jan. 1 Bonds Payable Premium on Bonds Payable Cash Gain on Retirement of Bonds To record the retirement of bonds. Part 6: Assume that the market rate on January 1, 2013, is 12% instead of 10%. Without providing numbers, describe how this change affects the amounts reported on Ike's financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts