Question: Given information on the following two projects, which one would you recommend and why? (10 marks for each Project (ASB) (8) - 2 points for

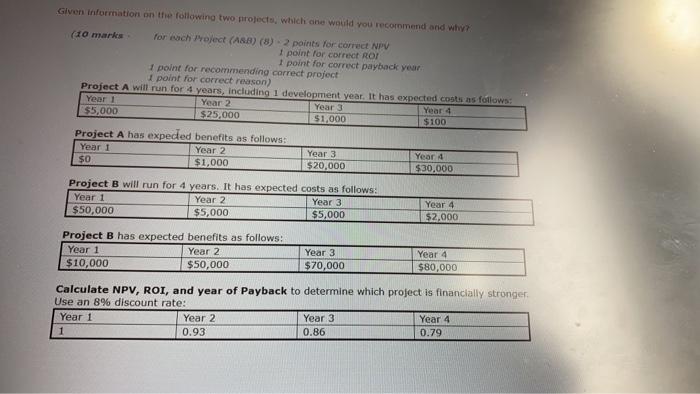

Given information on the following two projects, which one would you recommend and why? (10 marks for each Project (ASB) (8) - 2 points for correct NPV I point for correct ROI I point for correct payback year 1 point for recommending correct project I point for correct reason) Project A will run for 4 years, including I development year. It has expected costs as follows: Year 1 Year 3 Year 4 $5,000 $25,000 $1,000 $100 Project A has expected benefits as follows: Year 1 Year 2 Year 4 $0 $1,000 $20,000 Year 2 Year 3 $30,000 Project B will run for 4 years. It has expected costs as follows: Year 1 Year 2 Year 3 $50,000 $5,000 $5,000 Year 4 $2,000 Project B has expected benefits as follows: Year 1 $10,000 $50,000 Year 2 Year 3 $70,000 Year 4 $80,000 Calculate NPV, ROI, and year of Payback to determine which project is financially stronger Use an 8% discount rate: Year 2 Year 1 Year 3 Year 4 1 0.93 0.86 0.79

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts