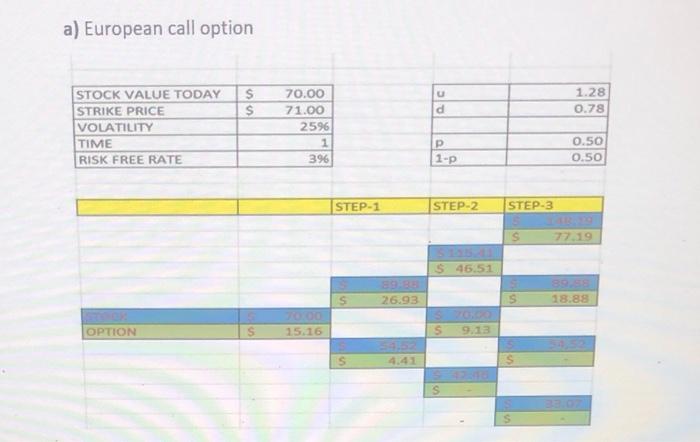

Question: given part A and B. please solve part E explaining the aribtrage startegy, thank you . a) European call option s $ 1.28 0.78 d

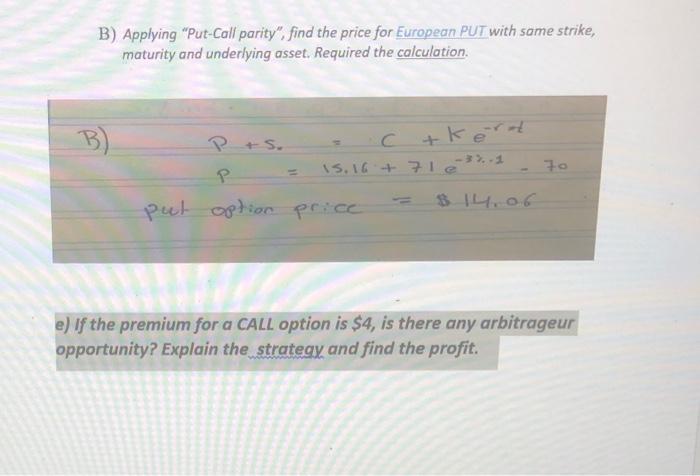

a) European call option s $ 1.28 0.78 d STOCK VALUE TODAY STRIKE PRICE VOLATILITY TIME RISK FREE RATE 70.00 71.00 2596 1 396 1-p 0.50 0.50 STEP-1 STEP-2 STEP-3 77.19 S 46.51 26.93 s 18.88 OPTION 15.16 9.13 B) Applying "Put-Call parity", find the price for European PUT with same strike, maturity and underlying asset. Required the calculation. B) Pts. tkrt 15.16 + 71e-3-1 70 put option price $1406 e) If the premium for a CALL option is $4, is there any arbitrageur opportunity? Explain the strategy and find the profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts