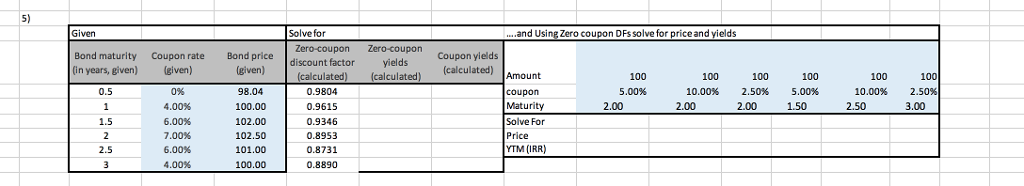

Question: Given Solve for .and Using Zero coupon DFs solve for price and yields Bond maturity (in years, given) Coupon rate (given) Bond price (given) Zero-coupon

Given Solve for .and Using Zero coupon DFs solve for price and yields Bond maturity (in years, given) Coupon rate (given) Bond price (given) Zero-coupon discount factor (calculated) Zero-coupon yields (calculated) Coupon yields (calculated) Amount 100 100 100 100 100 100 0.5 0% 98.04 0.9804 coupon 5.00% 10.00% 2.50% 5.00% 10.00% 2.50% 1 4.00% 100.00 0.9615 Maturity 2.00 2.00 2.00 1.50 2.50 3.00 1.5 6.00% 102.00 0.9346 Solve For 2 7.00% 102.50 0.8953 Price 2.5 6.00% 101.00 0.8731 YTM (IRR) 3 4.00% 100.00 0.8890

Please tell me how could you get the answer. Thanks

5) Given Solve for and Using Zero coupon DFs solve for p eand yields Bond maturity Coupon rate in years, given) (given) Zero-coupon yields Bond price given) 98.04 100.00 102.00 102.50 101.00 100.00 Coupon yields discount factor Amount coupon Maturity Solve For Price YTM (IRR) 100 100 10.00% 100 2.50% 2.00 100 5.00% 1.50 100 100 2.50% 3.00 ated)(calculated (calculated) 0.5 096 4.00% 6.00% 7.00% 6.00% 4.00% 0.9804 0.9615 0.9346 0.8953 0.8731 0.8890 5.00% 10.00% 2.00 2.00 2.50 1.5 2.5 5) Given Solve for and Using Zero coupon DFs solve for p eand yields Bond maturity Coupon rate in years, given) (given) Zero-coupon yields Bond price given) 98.04 100.00 102.00 102.50 101.00 100.00 Coupon yields discount factor Amount coupon Maturity Solve For Price YTM (IRR) 100 100 10.00% 100 2.50% 2.00 100 5.00% 1.50 100 100 2.50% 3.00 ated)(calculated (calculated) 0.5 096 4.00% 6.00% 7.00% 6.00% 4.00% 0.9804 0.9615 0.9346 0.8953 0.8731 0.8890 5.00% 10.00% 2.00 2.00 2.50 1.5 2.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts