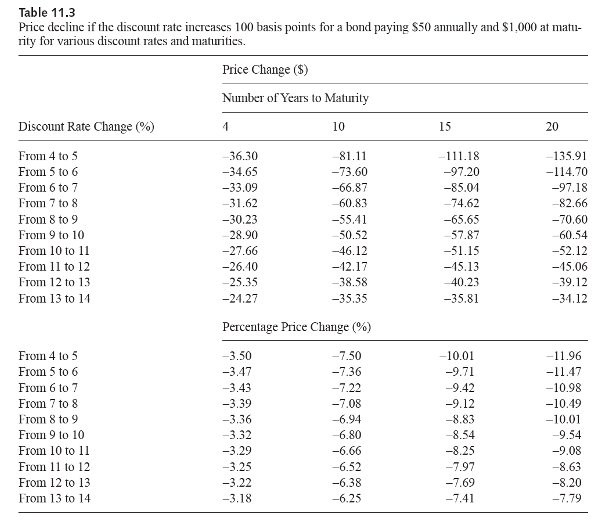

Question: Given Table 11.3, what is the price change for a 10-year, 5% coupon bond if the discount rate increases by 100 basis points from 9%

Given Table 11.3, what is the price change for a 10-year, 5% coupon bond

- if the discount rate increases by 100 basis points from 9% to 10%.

- If the discount rate decreases by 100 basis points from 7% to 6%

Table 11.3 Price decline if the discount rate increases 100 basis points for a bond paying $50 annually and $1,000 at matu- rity for various discount rates and maturities. Price Change ($) Number of Years to Maturity Discount Rate Change %) 10 15 20 1 From 4 to 5 From 5 to 6 From 6 to 7 From 7 to 8 From 8 to 9 From 9 to 10 From 10 to 11 From 11 to 12 From 12 to 13 From 13 to 14 36.30 -34.65 -33.09 -31.62 -30.23 28.90 -27.66 -26.10 -25.35 -24.27 81.11 -73.60 -66.87 -60.83 -55.41 50.52 -46.12 -12.17 -38.58 -35.35 111.18 -97.20 -85.01 -74.62 -65.65 57.87 -51.15 -15.13 40.23 -35.81 -135.91 -114.70 -97.18 82.66 -70.60 60.54 -52.12 -15.06 39.12 -34.12 Percentage Price Change %) From 4 to 5 From 5 to 6 From 6 to 7 From 7 to 8 From 8 to 9 From 9 to 10 From 10 to 11 Fron 11 to 12 From 12 to 13 From 13 to 14 -3.50 -3.47 -3.43 -3.39 -3.36 -3.32 -3.29 -3.25 -3.22 -3.18 -7.50 -7.36 -7.22 -7.08 -6.94 -6.80 -6.66 -6.52 -6.38 -6.25 -10.01 -9.71 -9.42 -9.12 -8.83 8.54 -8.25 -7.97 -7.69 -7.41 -11.96 -11.47 -10.98 -10.49 -10.01 -9.54 -9.08 -8.63 -8.20 -7.79

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts