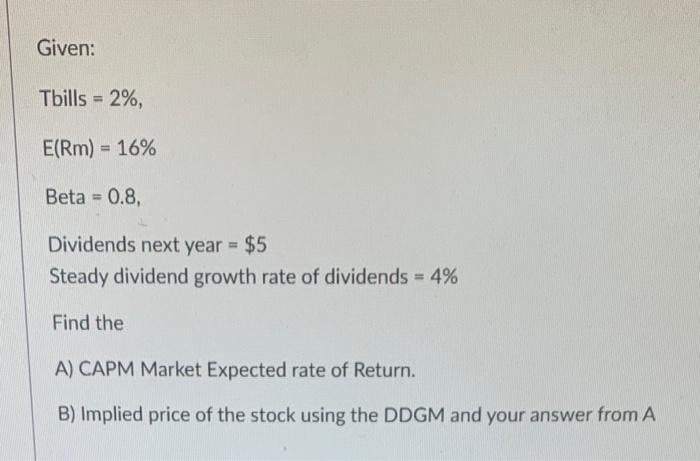

Question: Given: Tbills = 2%, E(Rm) = 16% Beta = 0.8, Dividends next year = $5 Steady dividend growth rate of dividends = 4% Find the

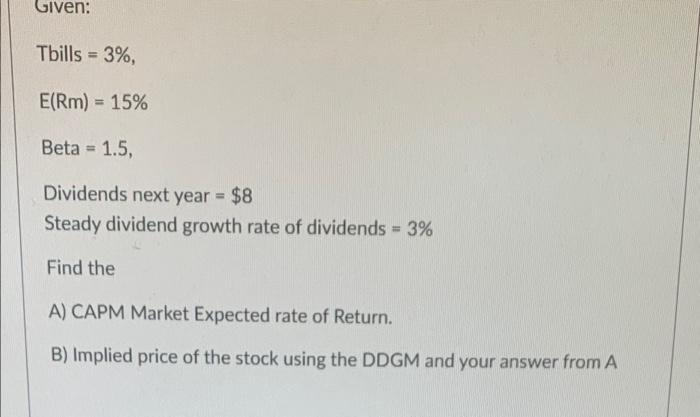

Given: Tbills = 2%, E(Rm) = 16% Beta = 0.8, Dividends next year = $5 Steady dividend growth rate of dividends = 4% Find the A) CAPM Market Expected rate of Return. B) Implied price of the stock using the DDGM and your answer from A Given: Tbills = 3%, E(Rm) = 15% Beta = 1.5, Dividends next year = $8 Steady dividend growth rate of dividends = 3% Find the A) CAPM Market Expected rate of Return. B) Implied price of the stock using the DDGM and your answer from A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts