Question: Given that answers, what are the solutions how it get? provide the solution ? Questions 30 and 31 are based on the following information. The

Given that answers, what are the solutions how it get?

provide the solution

?

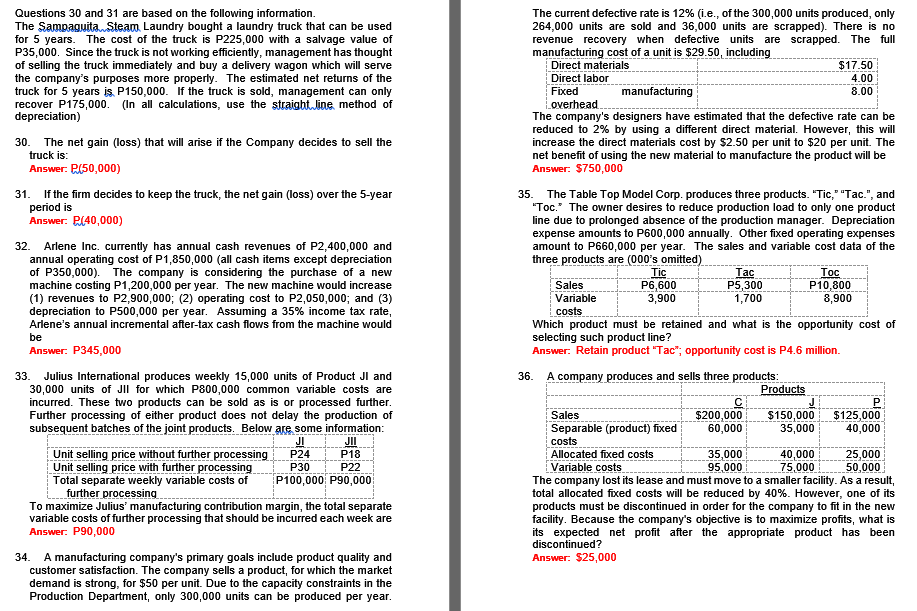

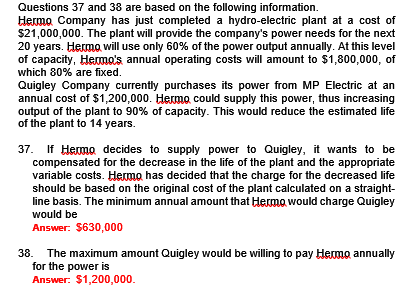

Questions 30 and 31 are based on the following information. The current defective rate is 12% (i.e., of the 300,000 units produced, only The Sampaguita Steam Laundry bought a laundry truck that can be used 264,000 units are sold and 36,000 units are scrapped). There is no for 5 years. The cost of the truck is P225,000 with a salvage value of revenue recovery when defective units are scrapped. The full P35,000. Since the truck is not working efficiently, management has thought manufacturing cost of a unit is $29.50, including of selling the truck immediately and buy a delivery wagon which will serve Direct materials $17.50 the company's purposes more properly. The estimated net returns of the Direct labor 4.00 truck for 5 years is P150,000. If the truck is sold, management can only Fixed manufacturing 8.00 recover P175,000. (In all calculations, use the straight line method of overhead. depreciation) The company's designers have estimated that the defective rate can be reduced to 2% by using a different direct material. However, this will 30. The net gain (loss) that will arise if the Company decides to sell the increase the direct materials cost by $2.50 per unit to $20 per unit. The truck is net benefit of using the new material to manufacture the product will be Answer: P(50,000) Answer: $750,000 31. If the firm decides to keep the truck, the net gain (loss) over the 5-year 35. The Table Top Model Corp. produces three products. "Tic," "Tac.", and period is "Toc." The owner desires to reduce production load to only one product Answer. P(40,000) line due to prolonged absence of the production manager. Depreciation expense amounts to P600,000 annually. Other fixed operating expenses 32. Arlene Inc. currently has annual cash revenues of P2,400,000 and amount to P660,000 per year. The sales and variable cost data of the annual operating cost of P1,850,000 (all cash items except depreciation three products are (000's omitted) of P350,000). The company is considering the purchase of a new Tic Tac Toc machine costing P1,200,000 per year. The new machine would increase Sales P6,600 P5,300 P10,800 (1) revenues to P2,900,000; (2) operating cost to P2,050,000; and (3) Variable 3,900 1,700 8,900 depreciation to P500,000 per year. Assuming a 35% income tax rate, costs Arlene's annual incremental after-tax cash flows from the machine would Which product must be retained and what is the opportunity cost of be selecting such product line? Answer: P345,000 Answer: Retain product "Tac"; opportunity cost is P4.6 million. 33. Julius International produces weekly 15,000 units of Product JI and 36. A company produces and sells three products: 30,000 units of Jil for which P800,000 common variable costs are Products incurred. These two products can be sold as is or processed further. Further processing of either product does not delay the production of Sales $200,000 $150,000 $125,000 subsequent batches of the joint products._Below are some information: Separable (product) fixed 60,000 35,000 40,000 JI JII costs Unit selling price without further processing P24 P18 Allocated fixed costs 35,000 40,000 25,000 Unit selling price with further processing P30 P22 Variable costs 95,000 75,000 50,000 Total separate weekly variable costs of P100,000 P90,000 The company lost its lease and must move to a smaller facility. As a result, further processing total allocated fixed costs will be reduced by 40%. However, one of its To maximize Julius' manufacturing contribution margin, the total separate products must be discontinued in order for the company to fit in the new variable costs of further processing that should be incurred each week are facility. Because the company's objective is to maximize profits, what is Answer: P90,000 its expected net profit after the appropriate product has been discontinued? 34. A manufacturing company's primary goals include product quality and Answer: $25,000 customer satisfaction. The company sells a product, for which the market demand is strong, for $50 per unit. Due to the capacity constraints in the Production Department, only 300,000 units can be produced per year.Questions 37 and 38 are based on the following information. Hermo Company has just completed a hydro-electric plant at a cost of $21,000,000. The plant will provide the company's power needs for the next 20 years. Hermo will use only 60% of the power output annually. At this level of capacity, Hermo's annual operating costs will amount to $1,800,000, of which 80% are fixed. Quigley Company currently purchases its power from MP Electric at an annual cost of $1,200,000. Hermo could supply this power, thus increasing output of the plant to 90% of capacity. This would reduce the estimated life of the plant to 14 years. 37. If Hemo decides to supply power to Quigley, it wants to be compensated for the decrease in the life of the plant and the appropriate variable costs. Herno has decided that the charge for the decreased life should be based on the original cost of the plant calculated on a straight- line basis. The minimum annual amount that Hermo would charge Quigley would be Answer: $630,000 38. The maximum amount Quigley would be willing to pay Herno annually for the power is Answer. $1,200,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts