Question: Given that answers, what are the solutions how it get? provide the solution ? 17. Sandow Co. is currently operating at a loss of $15,000.

Given that answers, what are the solutions how it get?

provide the solution

?

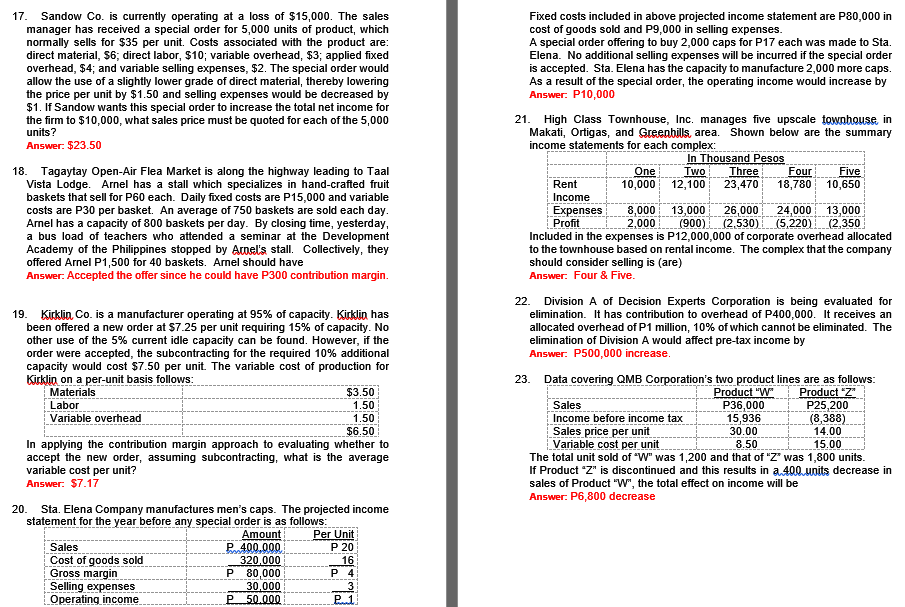

17. Sandow Co. is currently operating at a loss of $15,000. The sales Fixed costs included in above projected income statement are P80,000 in manager has received a special order for 5,000 units of product, which cost of goods sold and P9,000 in selling expenses normally sells for $35 per unit. Costs associated with the product are: A special order offering to buy 2,000 caps for P17 each was made to Sta. direct material, $6; direct labor, $10; variable overhead, $3; applied fixed Elena. No additional selling expenses will be incurred if the special order overhead, $4; and variable selling expenses, $2. The special order would is accepted. Sta. Elena has the capacity to manufacture 2,000 more caps. allow the use of a slightly lower grade of direct material, thereby lowering As a result of the special order, the operating income would increase by the price per unit by $1.50 and selling expenses would be decreased by Answer: P10,000 $1. If Sandow wants this special order to increase the total net income for the firm to $10,000, what sales price must be quoted for each of the 5,000 21. High Class Townhouse, Inc. manages five upscale townhouse in units? Makati, Ortigas, and Greenhills area. Shown below are the summary Answer: $23.50 income statements for each complex: In Thousand Pesos 18. Tagaytay Open-Air Flea Market is along the highway leading to Taal One Two Three Four Five Vista Lodge. Arnel has a stall which specializes in hand-crafted fruit Rent 10,000 12,100 23,470 18,780 10,650 baskets that sell for P60 each. Daily fixed costs are P15,000 and variable Income costs are P30 per basket. An average of 750 baskets are sold each day. Expenses 8,000 13,000 26,000 24,000 13,000; Amel has a capacity of 800 baskets per day. By closing time, yesterday, Profit 2,000 ! __(900) (2.530) | (5,220)1 (2,350 a bus load of teachers who attended a seminar at the Development Included in the expenses is P12,000,000 of corporate overhead allocated Academy of the Philippines stopped by Amel's stall. Collectively, they to the townhouse based on rental income. The complex that the company offered Arnel P1,500 for 40 baskets. Amel should have should consider selling is (are) Answer: Accepted the offer since he could have P300 contribution margin. Answer: Four & Five. 22. Division A of Decision Experts Corporation is being evaluated for 19. Kirklin Co. is a manufacturer operating at 95% of capacity. Kirklin has elimination. It has contribution to overhead of P400,000. It receives an been offered a new order at $7.25 per unit requiring 15% of capacity. No allocated overhead of P1 million, 10% of which cannot be eliminated. The other use of the 5% current idle capacity can be found. However, if the elimination of Division A would affect pre-tax income by order were accepted, the subcontracting for the required 10% additional Answer: P500,000 increase. capacity would cost $7.50 per unit. The variable cost of production for Kirklin on a per-unit basis follows: Data covering QMB Corporation's two product lines are as follows: Materials $3.50 Product "W" Product "2" Labor 1.50 Sales 36,000 P25,200 Variable overhead 1.50 Income before income tax 15,936 (8,388) $6.50 Sales price per unit 30.00 14.00 In applying the contribution margin approach to evaluating whether to Variable cost per unit 8.50 15.00 accept the new order, assuming subcontracting, what is the average The total unit sold of "W" was 1,200 and that of "2" was 1,800 units. variable cost per unit? If Product "Z" is discontinued and this results in a 400 upits decrease in Answer: $7.17 sales of Product "W", the total effect on income will be Answer: P6,800 decrease 20. Sta. Elena Company manufactures men's caps. The projected income statement for the year before any special order is as follows Amount Per Unit Sales P 400 000 P 20 Cost of goods sold 320,000 16 Gross margin P 80,000 P 4 Selling expenses 30,000 Operating income P 50.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts