Question: Given that fixed income security will generate cash flows Y1, Y2,..., Yn at points T1, T2,..., Tn, please explain that the value of this fixed

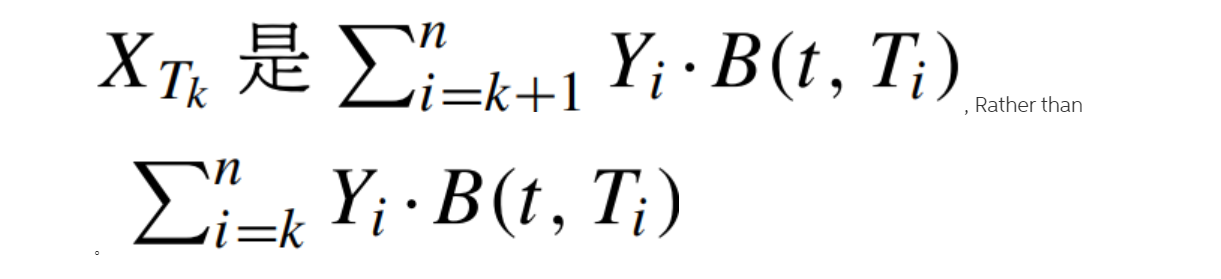

Given that fixed income security will generate cash flows Y1, Y2,..., Yn at points T1, T2,..., Tn, please explain that the value of this fixed income security at point Tk, XTk is

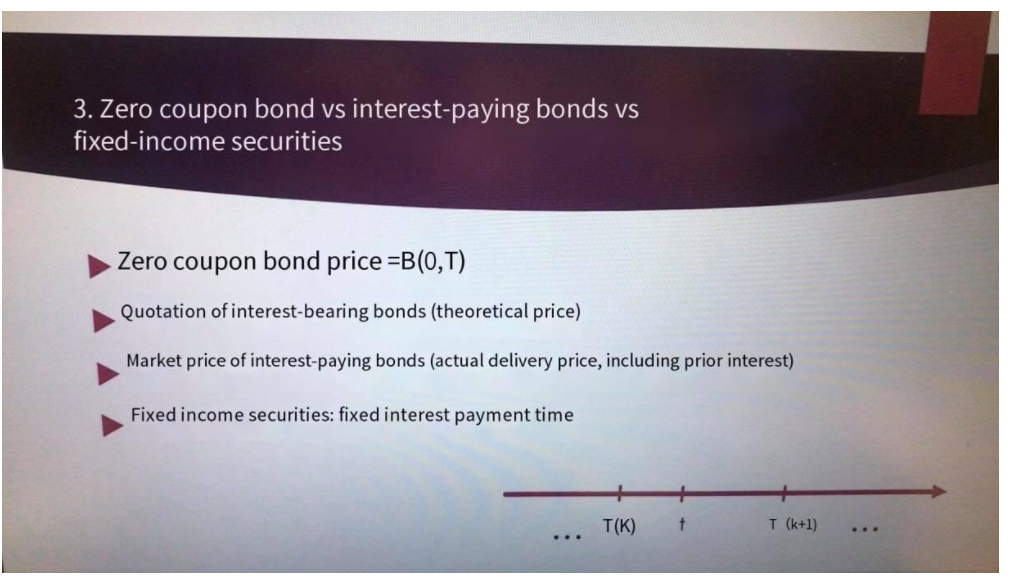

, Rather than , ; - (t, T;) (t, T;) 3. Zero coupon bond vs interest-paying bonds vs fixed-income securities Zero coupon bond price =B(0,T) Quotation of interest-bearing bonds (theoretical price) Market price of interest-paying bonds (actual delivery price, including prior interest) Fixed income securities: fixed interest payment time T(K) t T (k+1) ... , Rather than , ; - (t, T;) (t, T;) 3. Zero coupon bond vs interest-paying bonds vs fixed-income securities Zero coupon bond price =B(0,T) Quotation of interest-bearing bonds (theoretical price) Market price of interest-paying bonds (actual delivery price, including prior interest) Fixed income securities: fixed interest payment time T(K) t T (k+1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts