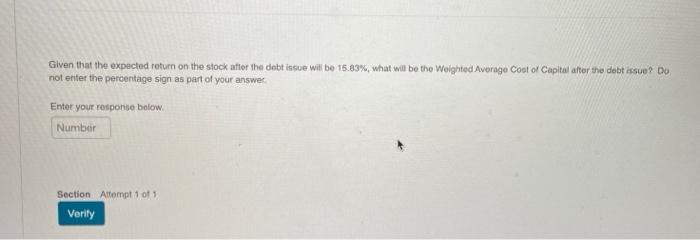

Question: Given that the expected return on the stock after the debt issue will be 15.83%, what will be the Weighted Average Cost of Capital after

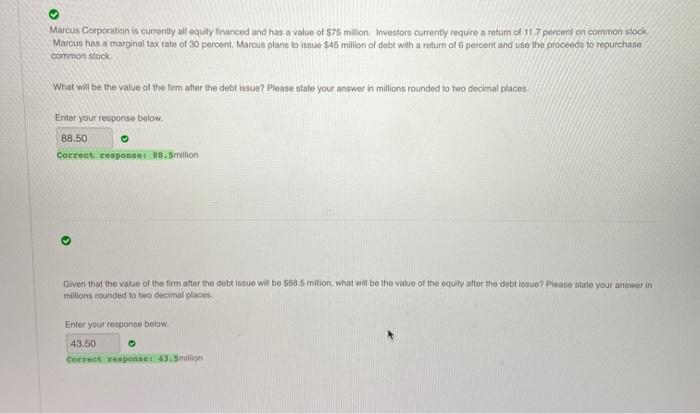

Given that the expected return on the stock after the debt issue will be 15.83%, what will be the Weighted Average Cost of Capital after the debt issue? Do not enter the percentage sign as part of your answer Enter your response below. Number Section Attempt 1 of 1 Verity Marcus Corporation is currently all equity financed and has a value of 575 million. Investors currently require a retum of 11.7 percent on common stock Mattus has a marginal tax rato of 30 percent. Marcus plans to Issue $45 million of debt with a return of 6 percent and use the proceeds to repurchana common stock What will be the value of the firm after the debt issue? Please state your answer in millions rounded to two decimal places. Enter your response below. 88.50 Correct responses 18.5million Given that the value of the firm after the debt issue will be $885 milion, what will be the value of the equity after the debt issue? Ploaie state your answer in millons rounded to two decimal places Enter your response below 43.50 Correct response 43.5 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts