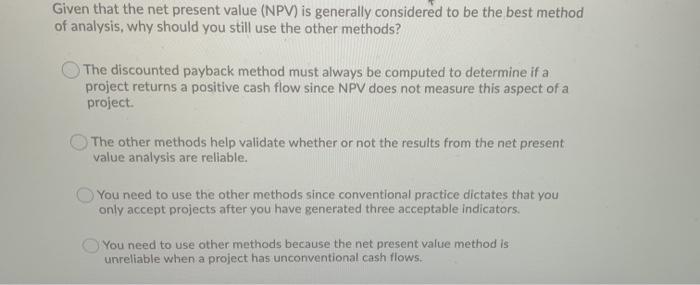

Question: Given that the net present value (NPV) is generally considered to be the best method of analysis, why should you still use the other methods?

Given that the net present value (NPV) is generally considered to be the best method of analysis, why should you still use the other methods? The discounted payback method must always be computed to determine if a project returns a positive cash flow since NPV does not measure this aspect of a project. The other methods help validate whether or not the results from the net present value analysis are reliable. You need to use the other methods since conventional practice dictates that you only accept projects after you have generated three acceptable indicators. You need to use other methods because the net present value method is unreliable when a project has unconventional cash flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts