Question: Given that the risk-free rate is 2%, the expected return on the marketportfolio is 15%, and the standard deviation of returns to the market portfolio

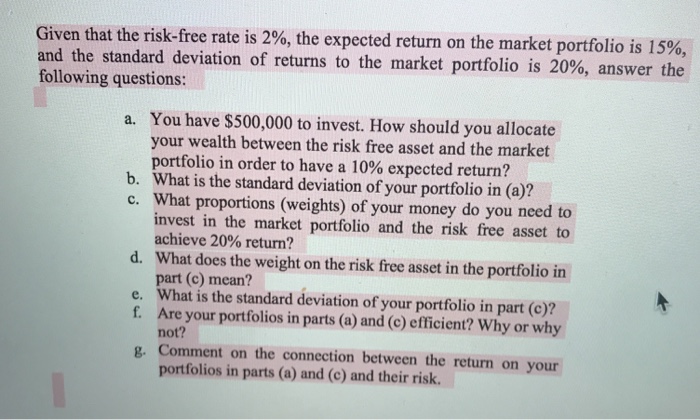

Given that the risk-free rate is 2%, the expected return on the marketportfolio is 15%, and the standard deviation of returns to the market portfolio is 20%, answer the following questions: a. You have S500,000 to invest. How should you allocate your wealth between the risk free asset and the market portfolio in order to have a 10% expected return? What is the standard deviation of your portfolio in (a)? b. c. What proportions (weights) of your money do you need to invest in the market portfolio and the risk free asset to achieve 20% return? What does the weight on the risk free asset in the portfolio in part (c) mean? What is the standard deviation of your portfolio in part (c)? d. e. f. Are your portfolios in parts (a) and (c) efficient? Why or why not? g. Comment on the connection between the return on your portfolios in parts (a) and (c) and their risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts