Question: Given the above equations how can I solve the question? Given the following information, compute the Weighted Average Cost of Capital (WACC) for Intemally generated

Given the above equations how can I solve the question?

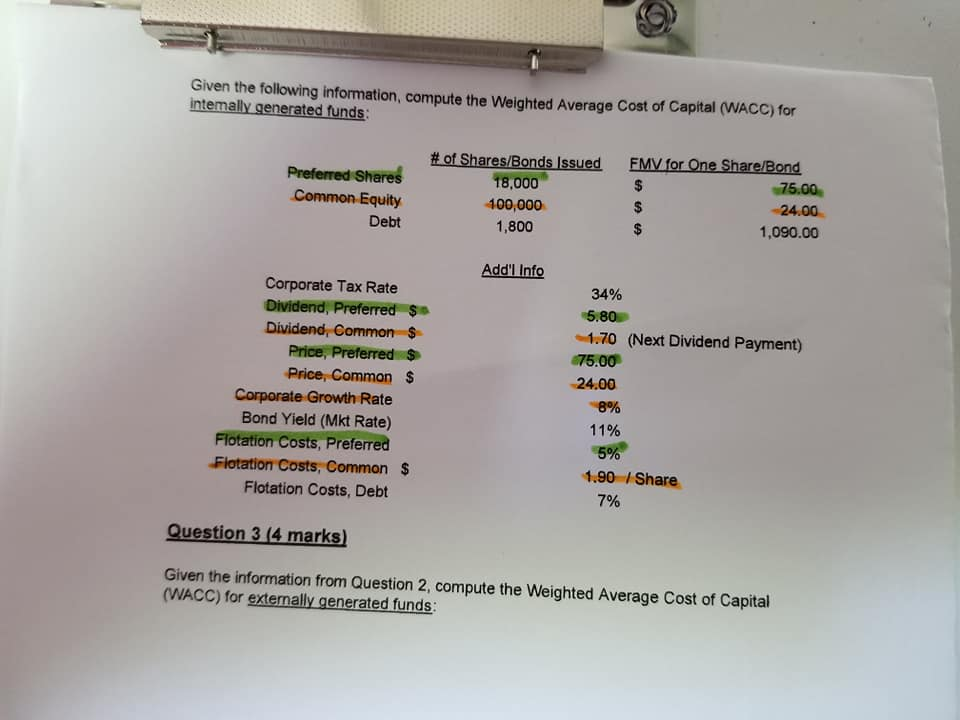

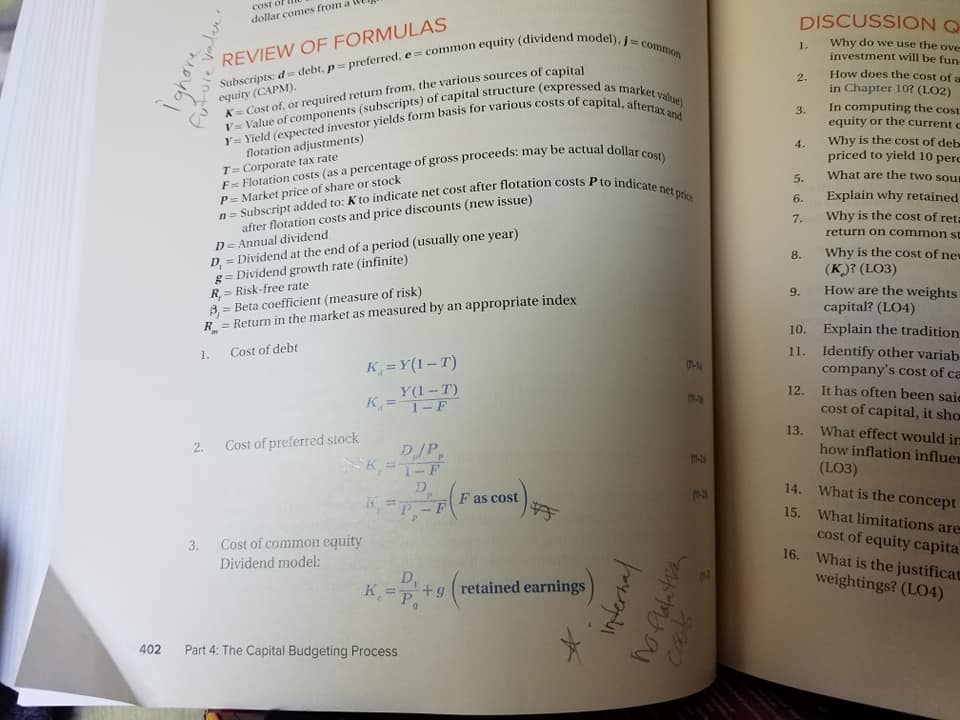

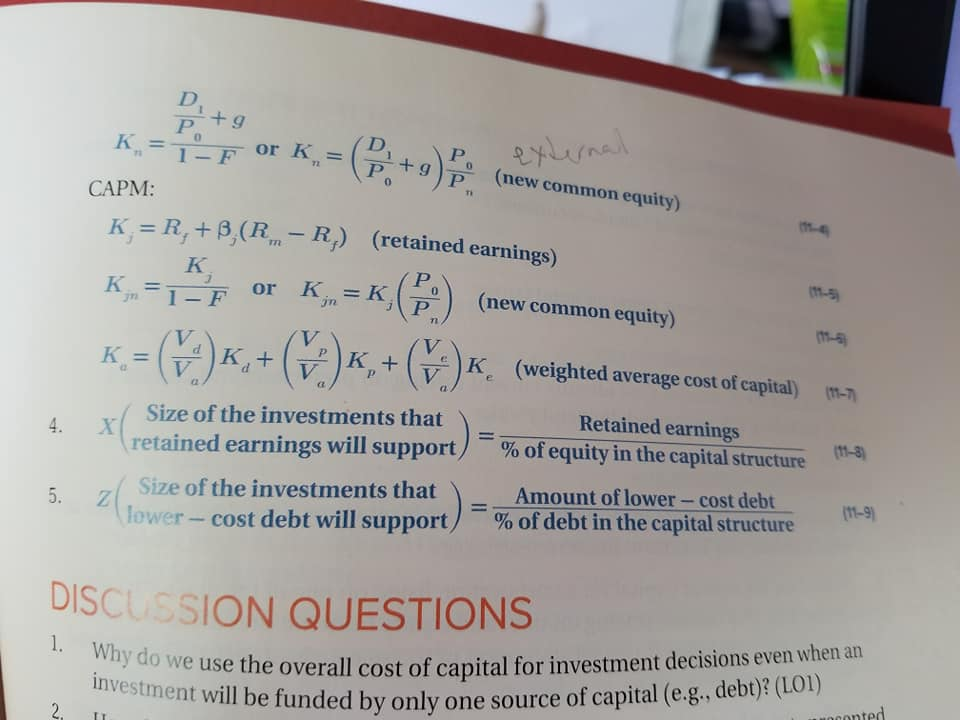

Given the following information, compute the Weighted Average Cost of Capital (WACC) for Intemally generated funds: Preferred Shares Common Equity Debt # of Shares/Bonds Issued 18,000 100,000 1,800 FMV for One Share/Bond $ 75.00 $ 24.00 $ 1,090.00 Add'l Info Corporate Tax Rate Dividend, Preferred $ Dividend, Common $ Price, Preferred $ Price, Common $ Corporate Growth Rate Bond Yield (Mkt Rate) Flotation Costs, Preferred Flotation Costs, Common $ Flotation Costs, Debt 34% 5.80 1.70 (Next Dividend Payment) 75.00 24.00 8% 11% 5% 1.90 /Share 7% Question 3 (4 marks) Given the information from Question 2, compute the Weighted Average Cost of Capital (WACC) for externally generated funds: Subscripts d debt. p= preferred, e-common equity (dividend model). = Common 1 Value of components (subscripts) of capital structure (expressed as market value) BYield (expected investor yields form basis for various costs of capital, aftertax and F=Hotation costs as a percentage of gross proceeds: may be actual dollar cost) n = Subscript added to: K to indicate net cost after flotation costs Pto indicate trepte CONTO dollar comes from 1. REVIEW OF FORMULAS ignore 2. equity (CAPM) * = Cost of, or required return from the various sources of capital 3. flotation adjustments) T=Corporate tax rate 5. P=Market price of share or stock 6. 7. DISCUSSION Q Why do we use the ove investment will be fun How does the cost of a in Chapter 102 (1.02) In computing the cost equity or the current Why is the cost of deb priced to yield 10 perc What are the two sou Explain why retained Why is the cost of ret return on common su Why is the cost of nes (KO? (LO3) 9. How are the weights capital? (L04) 10. Explain the tradition 11. Identify other variab company's cost of ca 12. It has often been said cost of capital, it sho 13. What effect would in how inflation influen (L03) 8. after flotation costs and price discounts (new issue) De Annual dividend D = Dividend at the end of a period (usually one year) g = Dividend growth rate (infinite) R - Risk-free rate 3 - Beta coefficient (measure of risk) R = Return in the market as measured by an appropriate index Cost of debt K =Y(1 T) Y(1 -T) K = 1-F 2. Cost of preferred stock D/P, Fas cost 14. What is the concept 15. What limitations are cost of equity capita 16. What is the justifica weightings? (LO4) 3. Cost of common equity Dividend model: KP D retained earnings internal 402 Part 4: The Capital Budgeting Process 1. Why do we use the overall cost of capital for investment decisions even when an D +9 . or K = 1 - F K = --+-) P P external 0 (new common equity) CAPM: K =R, +B,(R.. - R,) (retained earnings) K-1-7 or K.=KC) K (new common equity)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts