Question: Given the below data how you calculate the gross value of 1529,05 and 1897,02? Please provide the analytical calculations As a business valuation expert, you

Given the below data how you calculate the gross value of 1529,05 and 1897,02? Please provide the analytical calculations

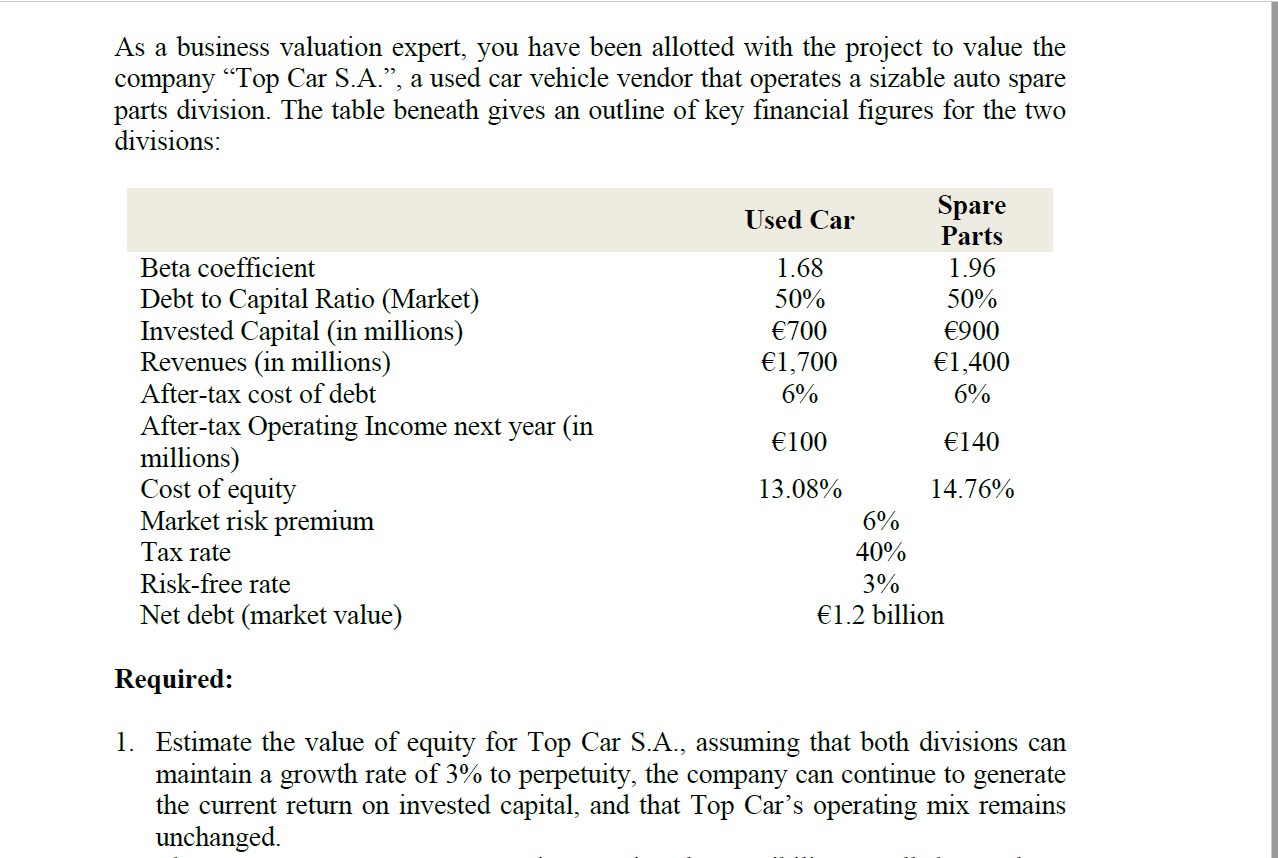

As a business valuation expert, you have been allotted with the project to value the company Top Car S.A., a used car vehicle vendor that operates a sizable auto spare parts division. The table beneath gives an outline of key financial figures for the two divisions: Used Car 1.68 50% 700 1,700 6% Spare Parts 1.96 50% 900 1,400 6% Beta coefficient Debt to Capital Ratio (Market) Invested Capital (in millions) Revenues (in millions) After-tax cost of debt After-tax Operating Income next year (in millions) Cost of equity Market risk premium Tax rate Risk-free rate Net debt (market value) 100 140 13.08% 14.76% 6% 40% 3% 1.2 billion Required: 1. Estimate the value of equity for Top Car S.A., assuming that both divisions can maintain a growth rate of 3% to perpetuity, the company can continue to generate the current return on invested capital, and that Top Car's operating mix remains unchanged

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts