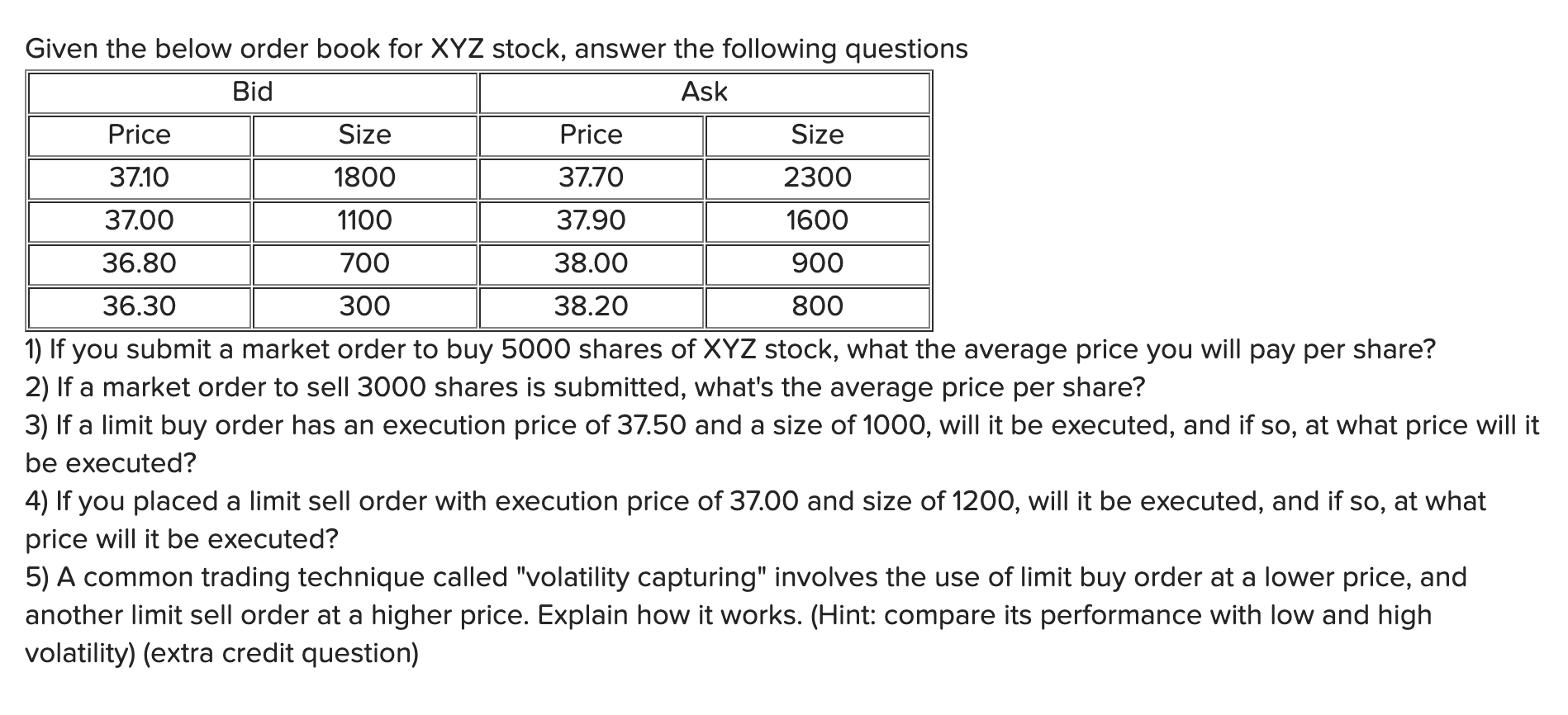

Question: Given the below order book for XYZ stock, answer the following questions Bid Ask Price Size Price Size 37.10 L 1800 37.70 2300 37.00 1100

Given the below order book for XYZ stock, answer the following questions Bid Ask Price Size Price Size 37.10 L 1800 37.70 2300 37.00 1100 37.90 1600 36.80 700 38.00 900 36.30 300 38.20 800 1) If you submit a market order to buy 5000 shares of XYZ stock, what the average price you will pay per share? 2) If a market order to sell 3000 shares is submitted, what's the average price per share? 3) If a limit buy order has an execution price of 37.50 and a size of 1000, will it be executed, and if so, at what price will it be executed? 4) If you placed a limit sell order with execution price of 37.00 and size of 1200, will it be executed, and if so, at what price will it be executed? 5) A common trading technique called "volatility capturing" involves the use of limit buy order at a lower price, and another limit sell order at a higher price. Explain how it works. (Hint: compare its performance with low and high volatility) (extra credit question)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts