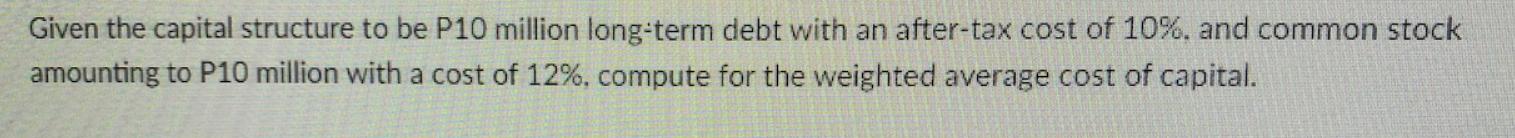

Question: Given the capital structure to be P10 million long-term debt with an after-tax cost of 10%. and common stock amounting to P10 million with

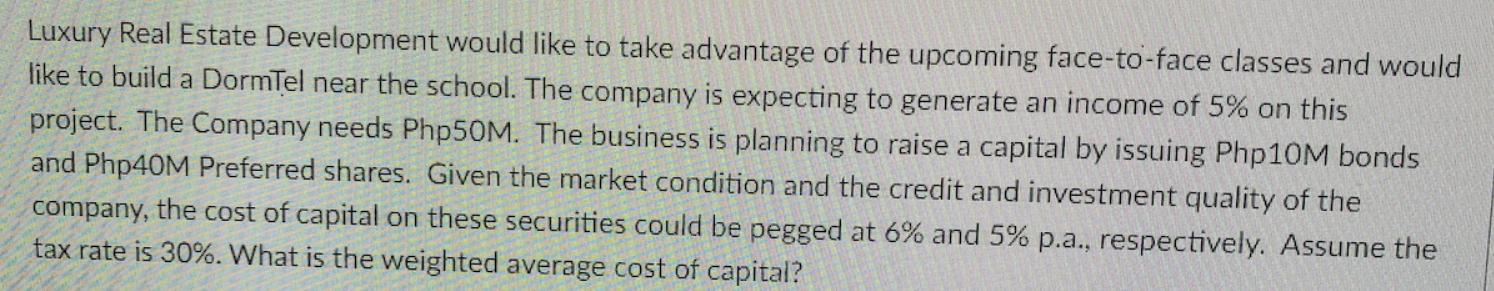

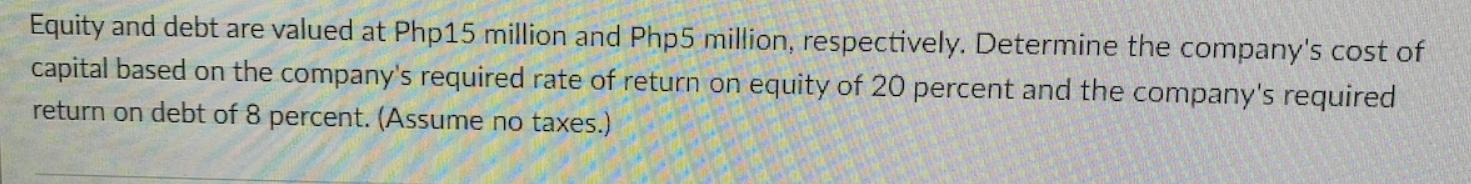

Given the capital structure to be P10 million long-term debt with an after-tax cost of 10%. and common stock amounting to P10 million with a cost of 12%, compute for the weighted average cost of capital. Luxury Real Estate Development would like to take advantage of the upcoming face-to-face classes and would like to build a DormTel near the school. The company is expecting to generate an income of 5% on this project. The Company needs Php50M. The business is planning to raise a capital by issuing Php10M bonds and Php40M Preferred shares. Given the market condition and the credit and investment quality of the company, the cost of capital on these securities could be pegged at 6% and 5% p.a., respectively. Assume the tax rate is 30%. What is the weighted average cost of capital? Equity and debt are valued at Php15 million and Php5 million, respectively. Determine the company's cost of capital based on the company's required rate of return on equity of 20 percent and the company's required return on debt of 8 percent. (Assume no taxes.)

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

1 Compute the weighted average cost of capital WACC Given data D P10000000 Longterm debt Rd 10 Aftertax cost of debt E P10000000 Common stock Re 12 Co... View full answer

Get step-by-step solutions from verified subject matter experts