Question: Given the cash flows for the following 2 projects, which of the following is true assuming a discount rate of 14%? Project A: Investment $250,

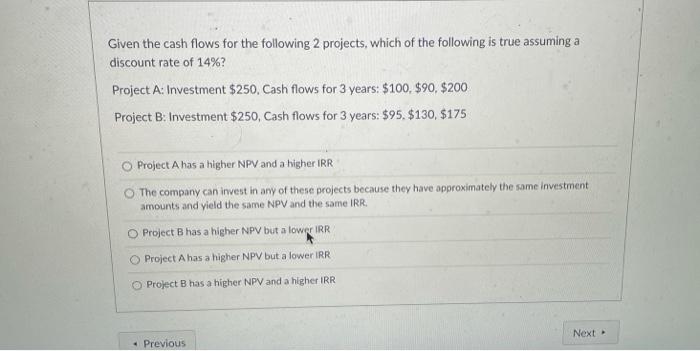

Given the cash flows for the following 2 projects, which of the following is true assuming a discount rate of 14%? Project A: Investment $250, Cash flows for 3 years: $100, $90, $200 Project B: Investment $250, Cash flows for 3 years: $95. $130, $175 Project A has a higher NPV and a higher IRR The company can invest in any of these projects because they have approximately the same investment amounts and yield the same NPV and the same IRR. O Project B has a higher NPV but a lower IRR Project A has a higher NPV but a lower IRR Project B has a higher NPV and a higher IRR Next Previous

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts