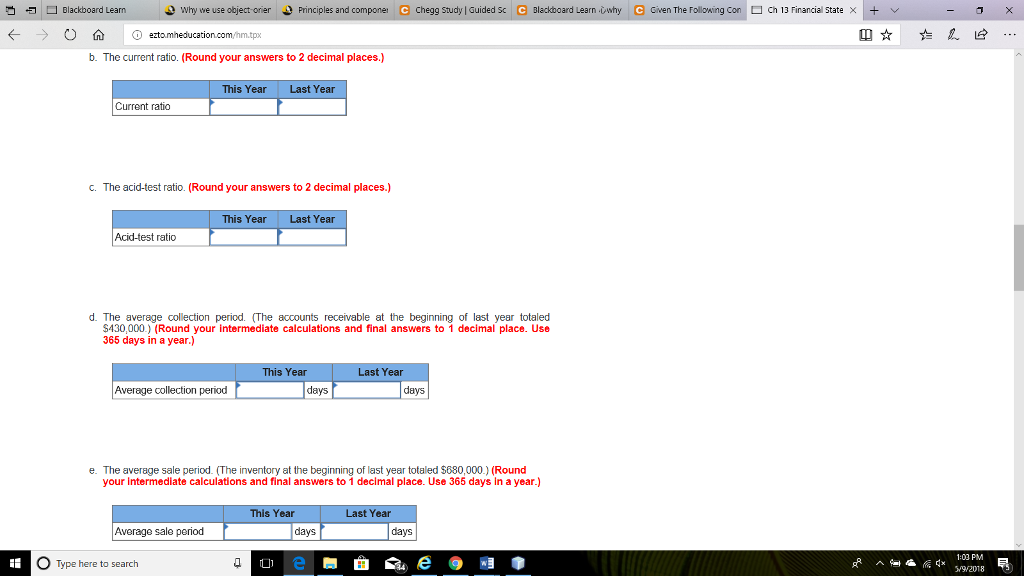

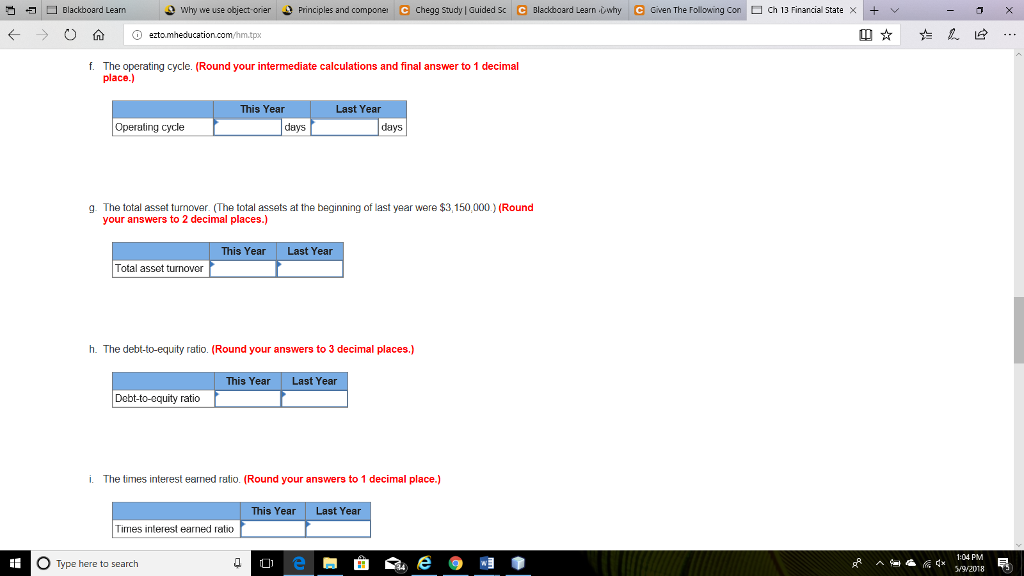

Question: Given the Comparative Balance Sheet and the Comparative Income Statement & Reconciliation, how would one solve items 1.) A.) through J.) and 2.) A.) and

Given the Comparative Balance Sheet and the Comparative Income Statement & Reconciliation, how would one solve items 1.) A.) through J.) and 2.) A.) and B.)? Thanks!

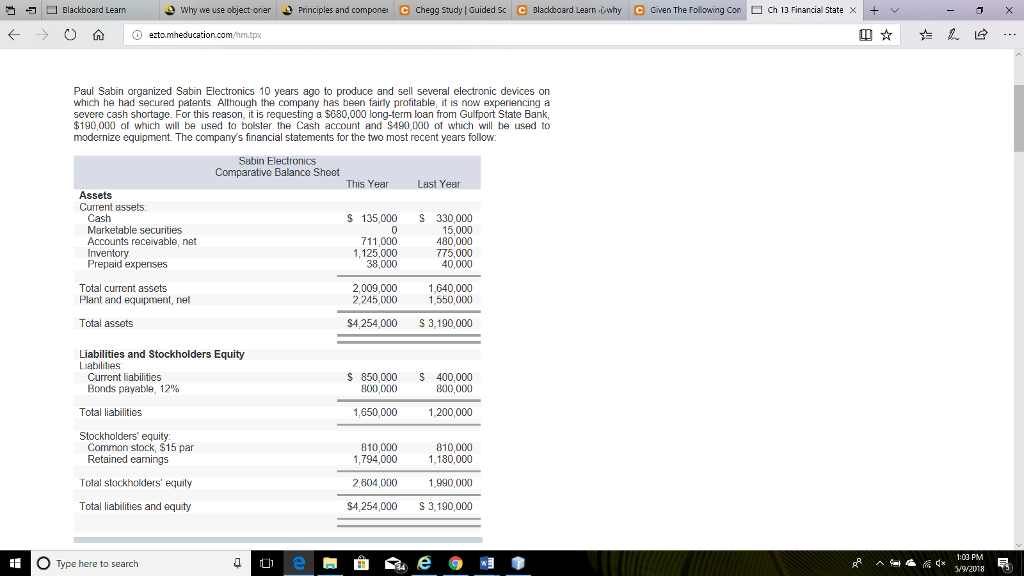

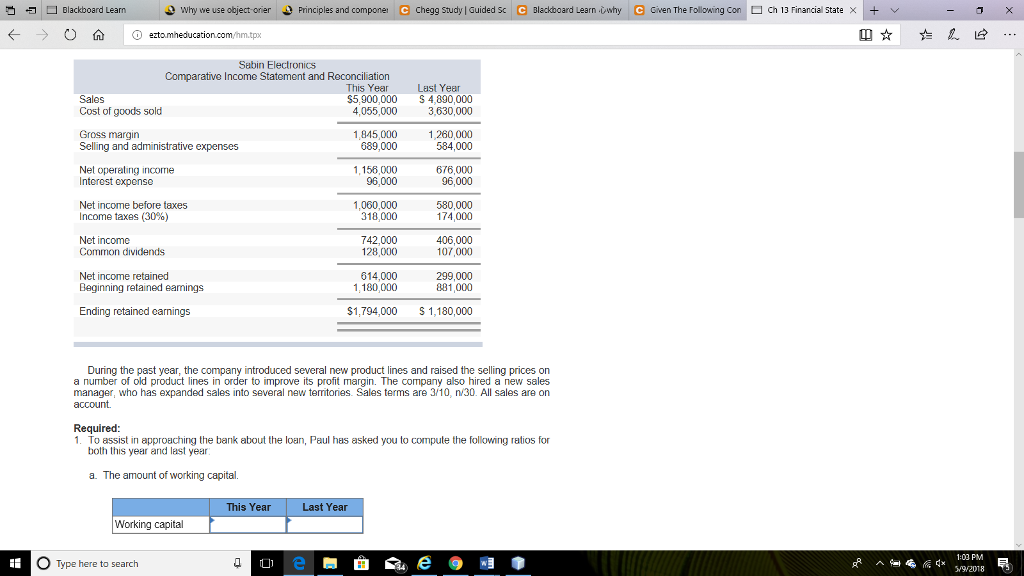

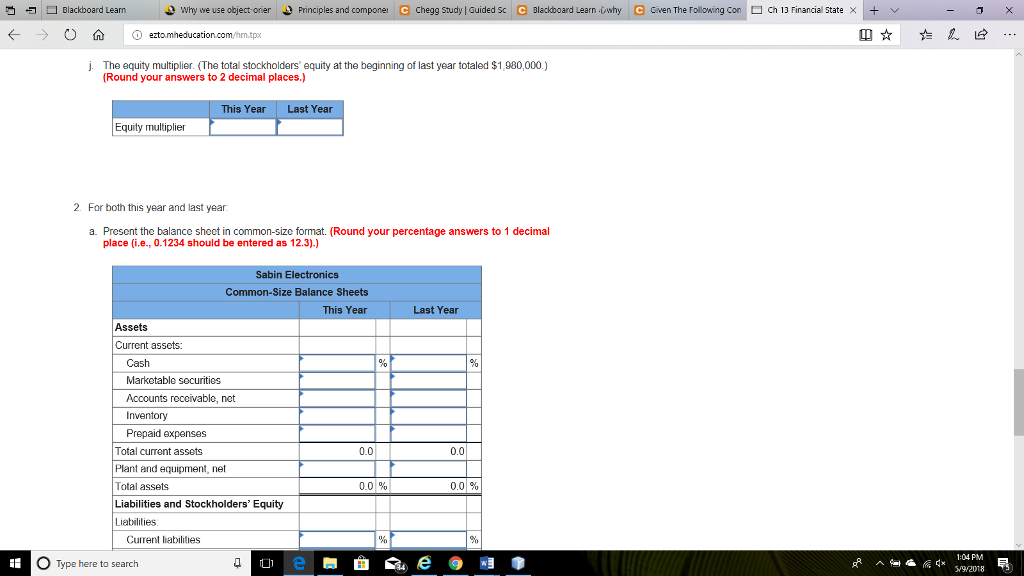

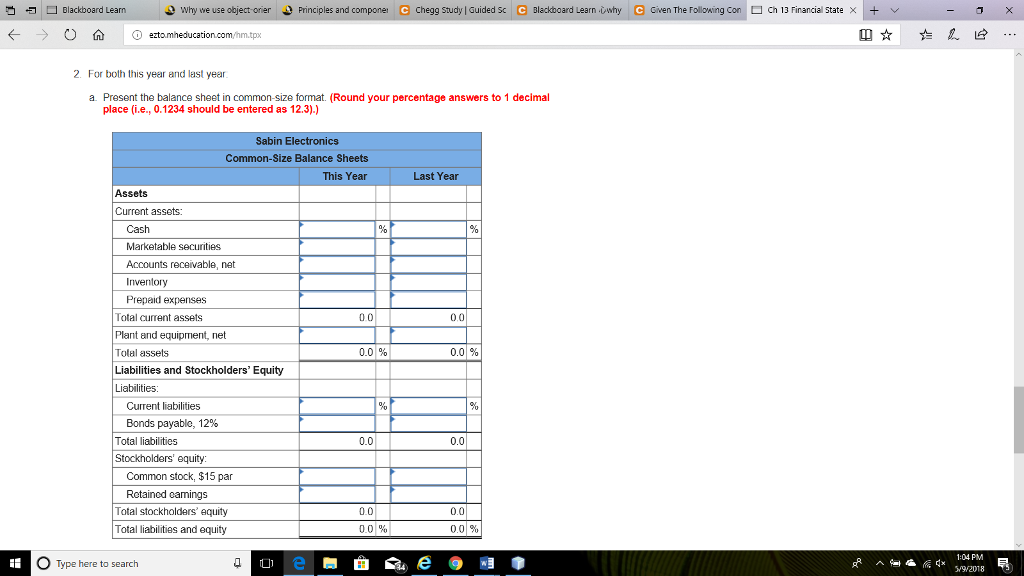

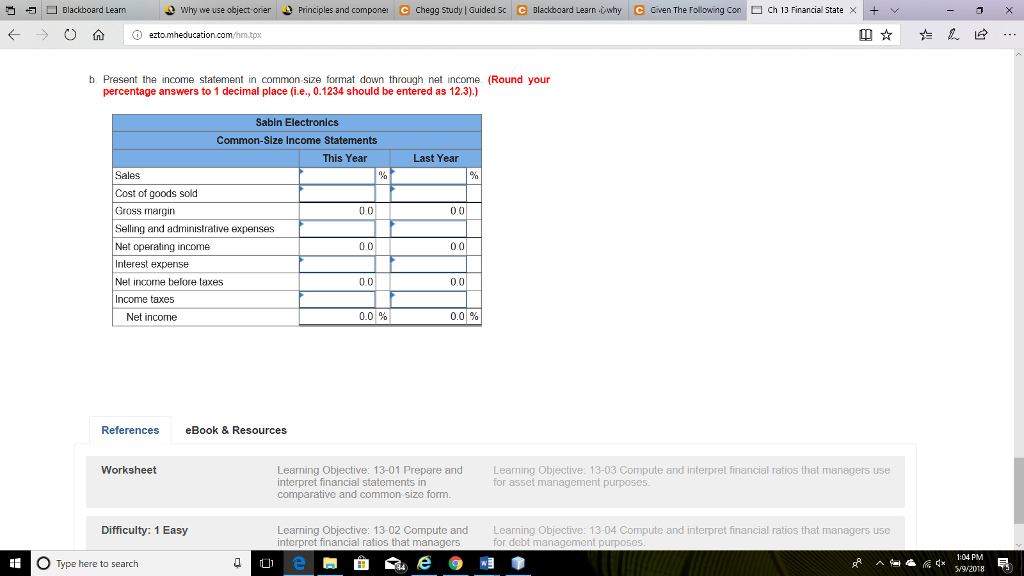

??? Blackboard Learn -) Why we use object or er Principles and componer e chegg Study Guided Sc Blackboard Learn why Gi en The Follo ing Con Ch 13 Financial State t ? Paul Sabin organized Sabin Electronics 10 years ago to produce and sell several electronic devices on which he had secured patents Although the company has been fairly profitable, it is now experiencing a severe cash shortage. For this reason, it is requesting a $680,000 long-term loan from Gulfport State Bank $190,000 of which wll be used to bolster the Cash account and $490,000 of which will be used to modernize equipment. The company's financial statements for the two most recent years follow. Sabin Electronics Comparative Balance Sheet This Year Last Year Assets Current assets Cash Accounts receivable, net Prepaid expenses S 135,000 S 330,000 711,000 1,125,000 38,000 480,000 775,000 40,000 Total current assets Plant and equipment, net 2,009,000 2,245,000 1,640,000 1,550,000 Total assets $4,254,000 S3,190,000 Liabilities and Stockholders Equity Liabilities Current liabilities Bonds payable, 12% S 850,000 S 400,000 800,000 800 000 Total liabilities 1,650,000 1200,000 Stockholders' equity Common stock, $15 par Retained eanings 810,000 1,794,000 810,000 1,180,000 1,990,000 $4,254,000 S3,190,000 Tolal stockholders' equily 2,504,000 Total liabilities and equity 1:03 PM Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts