Question: Given the data below, calculate the net present value using the equivalent annual value method. Assume the cost of capital is 10% p.a. Year 1

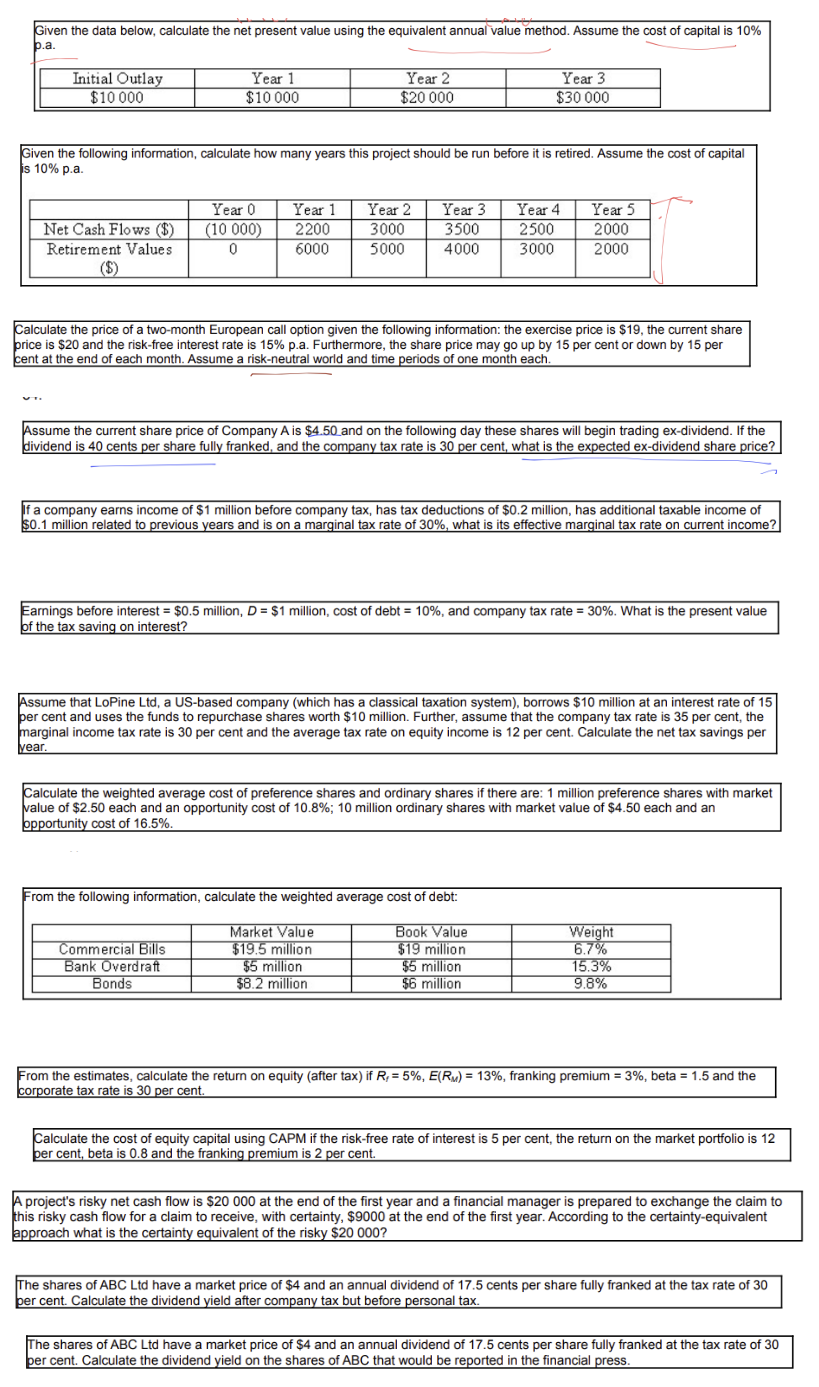

Given the data below, calculate the net present value using the equivalent annual value method. Assume the cost of capital is 10% p.a. Year 1 Year 2 Year 3 Initial Outlay $10 000 $10 000 $20 000 $30 000 Given the following information, calculate how many years this project should be run before it is retired. Assume the cost of capital is 10% p.a. Year 1 Year 2 Year 3 Year 4 Year 5 Year 0 (10 000) Net Cash Flows ($) 2200 3000 3500 2500 2000 Retirement Values 0 6000 5000 4000 3000 2000 ($) Calculate the price of a two-month European call option given the following information: the exercise price is $19, the current share price is $20 and the risk-free interest rate is 15% p.a. Furthermore, the share price may go up by 15 per cent or down by 15 per cent at the end of each month. Assume a risk-neutral world and time periods of one month each. Assume the current share price of Company A is $4.50 and on the following day these shares will begin trading ex-dividend. If the dividend is 40 cents per share fully franked, and the company tax rate is 30 per cent, what is the expected ex-dividend share price? If a company earns income of $1 million before company tax, has tax deductions of $0.2 million, has additional taxable income of $0.1 million related to previous years and is on a marginal tax rate of 30%, what is its effective marginal tax rate on current income? Earnings before interest = $0.5 million, D = $1 million, cost of debt = 10%, and company tax rate = 30%. What is the present value of the tax saving on interest? Assume that LoPine Ltd, a US-based company (which has a classical taxation system), borrows $10 million at an interest rate of 15 per cent and uses the funds to repurchase shares worth $10 million. Further, assume that the company tax rate is 35 per cent, the marginal income tax rate is 30 per cent and the average tax rate on equity income is 12 per cent. Calculate the net tax savings per year. Calculate the weighted average cost of preference shares and ordinary shares if there are: 1 million preference shares with market value of $2.50 each and an opportunity cost of 10.8%; 10 million ordinary shares with market value of $4.50 each and an opportunity cost of 16.5%. From the following information, calculate the weighted average cost of debt: Market Value Weight 6.7% $19.5 million Commercial Bills Bank Overdraft Bonds Book Value $19 million $5 million $6 million 15.3% $5 million $8.2 million 9.8% From the estimates, calculate the return on equity (after tax) if R, = 5%, E(RM) = 13%, franking premium = 3%, beta = 1.5 and the corporate tax rate is 30 per cent. Calculate the cost of equity capital using CAPM if the risk-free rate of interest is 5 per cent, the return on the market portfolio is 12 per cent, beta is 0.8 and the franking premium is 2 per cent. A project's risky net cash flow is $20 000 at the end of the first year and a financial manager is prepared to exchange the claim to this risky cash flow for a claim to receive, with certainty, $9000 at the end of the first year. According to the certainty-equivalent approach what is the certainty equivalent of the risky $20 000? The shares of ABC Ltd have a market price of $4 and an annual dividend of 17.5 cents per share fully franked at the tax rate of 30 per cent. Calculate the dividend yield after company tax but before personal tax. The shares of ABC Ltd have a market price of $4 and an annual dividend of 17.5 cents per share fully franked at the tax rate of 30 per cent. Calculate the dividend yield on the shares of ABC that would be reported in the financial press

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts