Question: (Given the data provided in Exhibit 1, how well run is KD compared to it industry peers? What are its primary strengths and weaknesses? Be

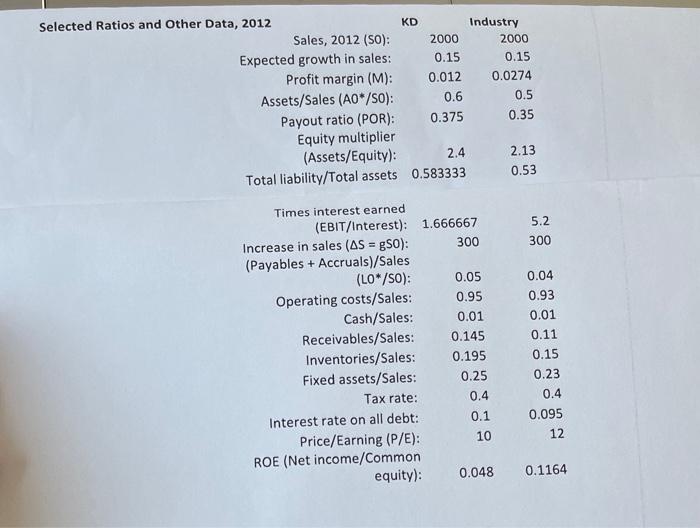

(Given the data provided in Exhibit 1, how well run is KD compared to it industry peers? What are its primary strengths and weaknesses? Be specific, using ratios in your answer. Be sure to also use the DuPont equation in your analysis. 2. Use the AFN equation to estimate KD's required external capital for 2013 if the expected 15% growth rate takes place. Assume the 2012 ratios (listed in question 6) will stay the same. 3. How would the following items impact AFN, holding everything else constant: capital intensity, growth rate, increase in A/P, profit margin, payout ratio. 4. What is KD's internal growth rate (aka self-supporting growth rate)? 0.6 Selected Ratios and Other Data, 2012 KD Industry Sales, 2012 (SO): 2000 2000 Expected growth in sales: 0.15 0.15 Profit margin (M): 0.012 0.0274 Assets/Sales (AO*/SO): 0.5 Payout ratio (POR): 0.375 0.35 Equity multiplier (Assets/Equity): 2.13 Total liability/Total assets 0.583333 0.53 2.4 5.2 300 0.04 Times interest earned (EBIT/Interest): 1.666667 Increase in sales (AS = gso): 300 (Payables + Accruals)/Sales (LO*/SO): 0.05 Operating costs/Sales: 0.95 Cash/Sales: 0.01 Receivables/Sales: 0.145 Inventories/Sales: 0.195 Fixed assets/Sales: 0.25 0.93 0.01 0.11 0.15 0.23 Tax rate: 0.4 0.4 0.1 0.095 10 12 Interest rate on all debt: Price/Earning (P/E): ROE (Net income/Common equity): 0.048 0.1164 (Given the data provided in Exhibit 1, how well run is KD compared to it industry peers? What are its primary strengths and weaknesses? Be specific, using ratios in your answer. Be sure to also use the DuPont equation in your analysis. 2. Use the AFN equation to estimate KD's required external capital for 2013 if the expected 15% growth rate takes place. Assume the 2012 ratios (listed in question 6) will stay the same. 3. How would the following items impact AFN, holding everything else constant: capital intensity, growth rate, increase in A/P, profit margin, payout ratio. 4. What is KD's internal growth rate (aka self-supporting growth rate)? 0.6 Selected Ratios and Other Data, 2012 KD Industry Sales, 2012 (SO): 2000 2000 Expected growth in sales: 0.15 0.15 Profit margin (M): 0.012 0.0274 Assets/Sales (AO*/SO): 0.5 Payout ratio (POR): 0.375 0.35 Equity multiplier (Assets/Equity): 2.13 Total liability/Total assets 0.583333 0.53 2.4 5.2 300 0.04 Times interest earned (EBIT/Interest): 1.666667 Increase in sales (AS = gso): 300 (Payables + Accruals)/Sales (LO*/SO): 0.05 Operating costs/Sales: 0.95 Cash/Sales: 0.01 Receivables/Sales: 0.145 Inventories/Sales: 0.195 Fixed assets/Sales: 0.25 0.93 0.01 0.11 0.15 0.23 Tax rate: 0.4 0.4 0.1 0.095 10 12 Interest rate on all debt: Price/Earning (P/E): ROE (Net income/Common equity): 0.048 0.1164

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts