Question: Given the data provided what is the expected return for Target's common stock using the Capital Asset Pricing Model? Risk free Bonds Data Preferred stock

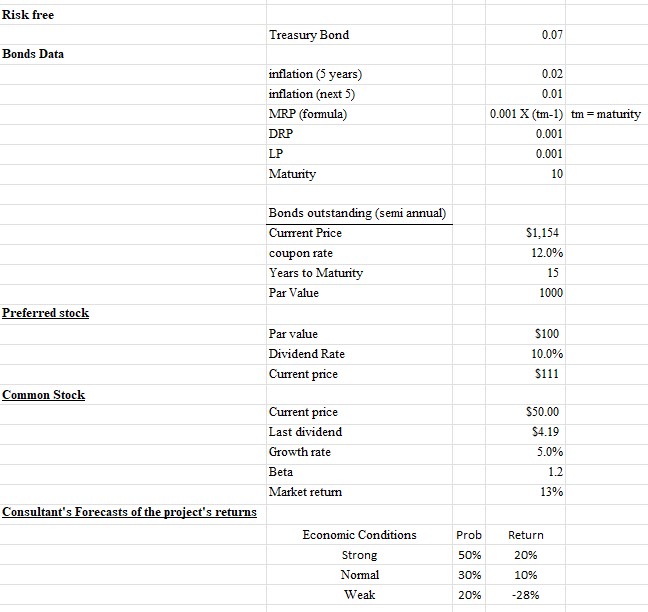

Given the data provided what is the expected return for Target's common stock using the Capital Asset Pricing Model?

Risk free Bonds Data Preferred stock Common Stock Consultant's Forecasts of the project's returns Treasury Bond inflation (5 years) inflation (next 5) MRP (formula) DRP LP Maturity Bonds outstanding (semi annual) Current Price coupon rate Years to Maturity Par Value Par value Dividend Rate Current price Current price Last dividend Growth rate Beta Market return Economic Conditions Strong Normal Weak Prob 50% 30% 20% 0.07 0.02 0.01 0.001 X(tm-1) tm = maturity 0.001 0.001 10 $1,154 12.0% 15 1000 $100 10.0% $111 $50.00 $4.19 5.0% 1.2 13% Return 20% 10% -28%

Step by Step Solution

There are 3 Steps involved in it

To calculate the expected return for Targets common stock using the Capital Asset Pricing Model CAPM ... View full answer

Get step-by-step solutions from verified subject matter experts