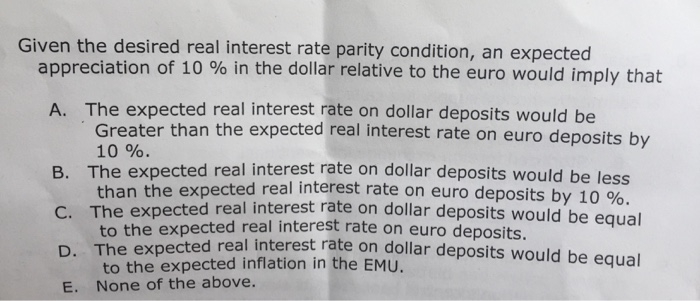

Question: Given the desired real interest rate parity condition, an expected appreciation of 10 % in the dollar relative to the euro would imply that The

Given the desired real interest rate parity condition, an expected appreciation of 10 % in the dollar relative to the euro would imply that The expected real interest rate on dollar deposits would be A. Greater than the expected real 10 %. interest rate on euro deposits by B. The expected real interest rate on C. D. E. None of the above. dollar deposits would be less than the expected real interest rate on euro deposits by 10 %. The expe to the expected real interest rate on euro deposits. The expe to the expected inflation in the EMU. cted real interest rate on dollar deposits would be equal cted real interest rate on dollar deposits would be equal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts