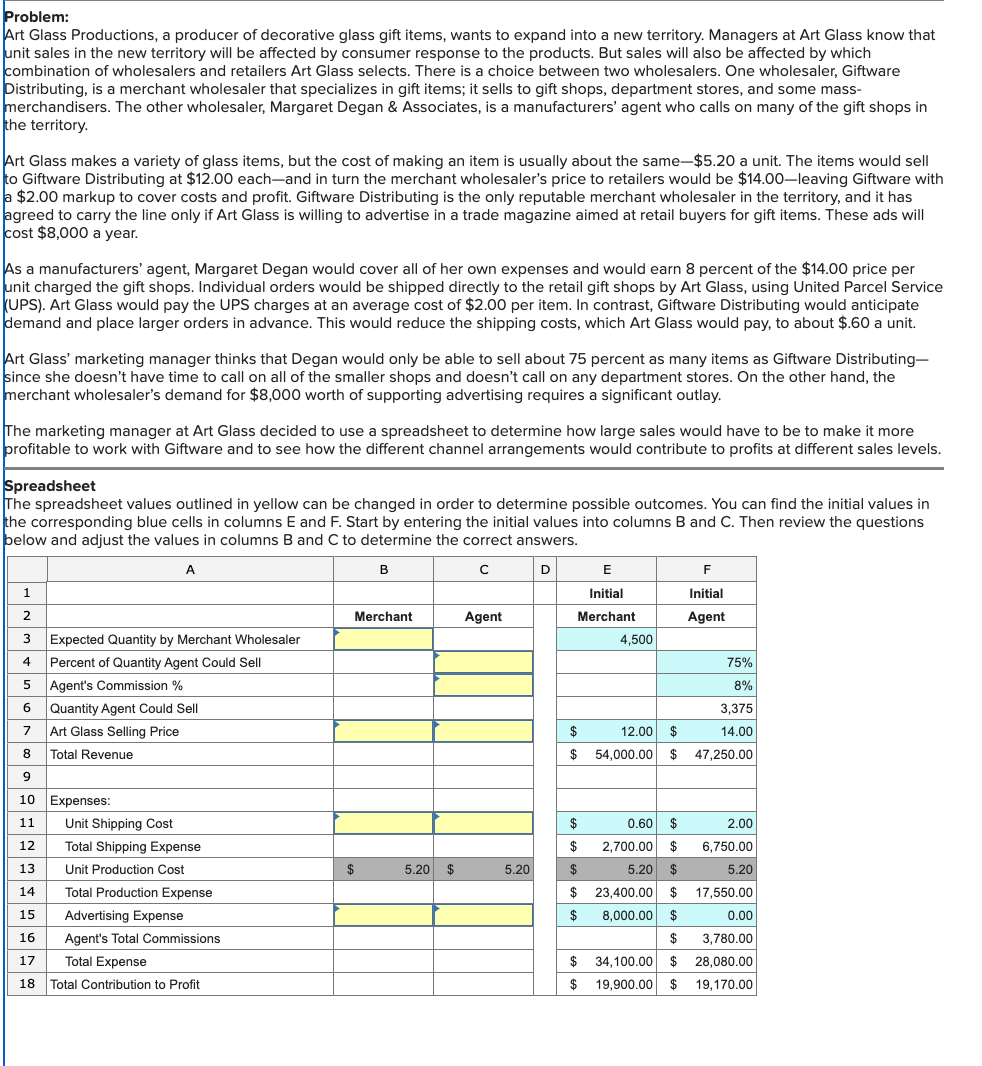

Question: Given the estimated unit sales and other values shown on the initial spreadsheet, which type of wholesaler would contribute the most profit to Art Glass

Given the estimated unit sales and other values shown on the initial spreadsheet, which type of wholesaler would contribute the most profit to Art Glass Productions?

a. The merchant wholesaler, Giftware Distributing

b. The manufacturer's agent, Margaret Degan

c. Both would provide equal profit

If Art Glass could convince Margaret Degan to carry inventory in order to reduce shipping costs as part of the preferred provider program, what would the expected profit contribution be assuming unit shipping costs were dropped to $1.00 per unit. The terms of the preferred provider program are provided in the preceding question.

a. $18,100.00

b. $20,655.00

c. $22,545.00

d. $24,786.00

e. $27,054.00

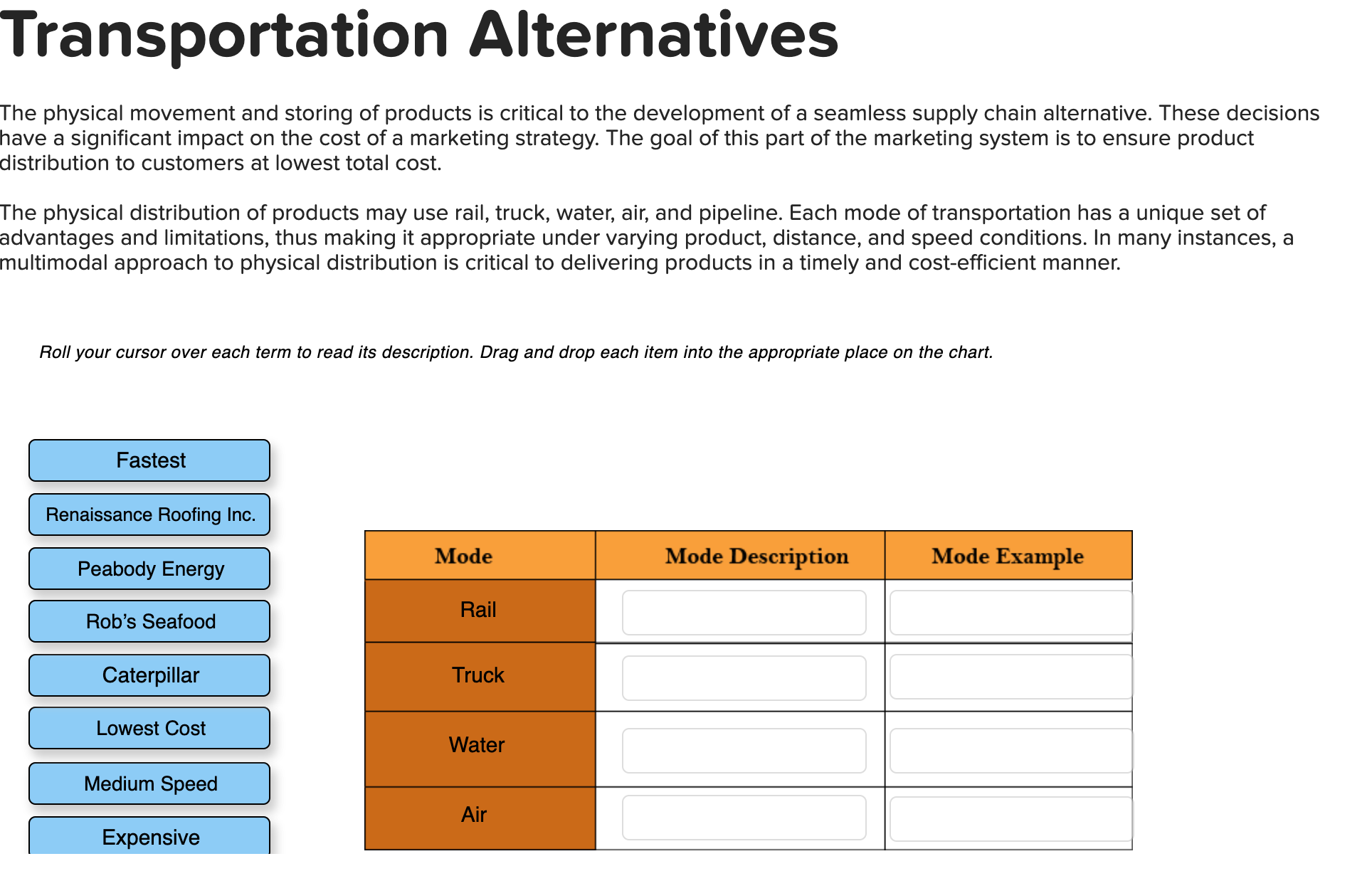

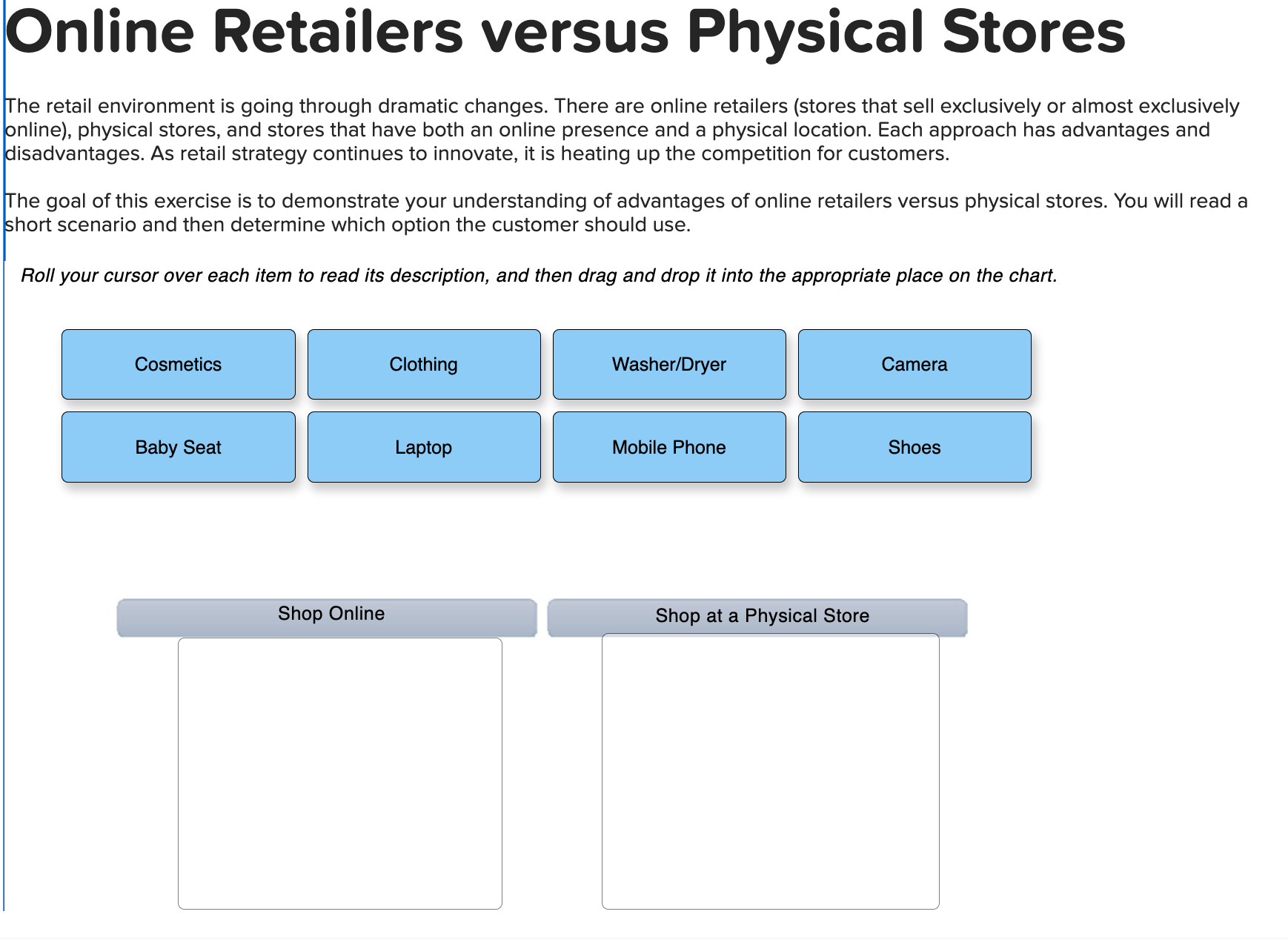

Transportation Alternatives Online Retailers versus Physical Stores Art Glass Productions, a producer of decorative glass gift items, wants to expand into a new territory. Managers at Art Glass know that unit sales in the new territory will be affected by consumer response to the products. But sales will also be affected by which combination of wholesalers and retailers Art Glass selects. There is a choice between two wholesalers. One wholesaler, Giftware Distributing, is a merchant wholesaler that specializes in gift items; it sells to gift shops, department stores, and some massmerchandisers. The other wholesaler, Margaret Degan \& Associates, is a manufacturers' agent who calls on many of the gift shops in the territory. Art Glass makes a variety of glass items, but the cost of making an item is usually about the same- $5.20 a unit. The items would sell to Giftware Distributing at $12.00 each-and in turn the merchant wholesaler's price to retailers would be $14.00l leaving Giftware with a \$2.00 markup to cover costs and profit. Giftware Distributing is the only reputable merchant wholesaler in the territory, and it has agreed to carry the line only if Art Glass is willing to advertise in a trade magazine aimed at retail buyers for gift items. These ads will cost $8,000 a year. As a manufacturers' agent, Margaret Degan would cover all of her own expenses and would earn 8 percent of the $14.00 price per unit charged the gift shops. Individual orders would be shipped directly to the retail gift shops by Art Glass, using United Parcel Service (UPS). Art Glass would pay the UPS charges at an average cost of $2.00 per item. In contrast, Giftware Distributing would anticipate demand and place larger orders in advance. This would reduce the shipping costs, which Art Glass would pay, to about $.60 a unit. Art Glass' marketing manager thinks that Degan would only be able to sell about 75 percent as many items as Giftware Distributing since she doesn't have time to call on all of the smaller shops and doesn't call on any department stores. On the other hand, the merchant wholesaler's demand for $8,000 worth of supporting advertising requires a significant outlay. The marketing manager at Art Glass decided to use a spreadsheet to determine how large sales would have to be to make it more profitable to work with Giftware and to see how the different channel arrangements would contribute to profits at different sales levels. Spreadsheet The spreadsheet values outlined in yellow can be changed in order to determine possible outcomes. You can find the initial values in the corresponding blue cells in columns E and F. Start by entering the initial values into columns B and C. Then review the questions below and adjust the values in columns B and C to determine the correct answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts