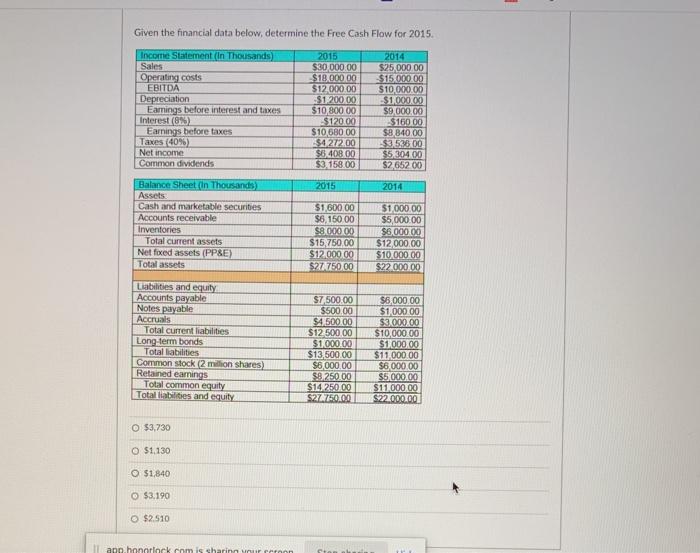

Question: Given the financial data below, determine the Free Cash Flow for 2015 Income Statement (In Thousands) Sales Operating costs EBITDA Depreciation Earings before interest and

Given the financial data below, determine the Free Cash Flow for 2015 Income Statement (In Thousands) Sales Operating costs EBITDA Depreciation Earings before interest and taxes Interest (8%) Earnings before taxes Taxes (40%) Net income Common dividends 2015 $30 000.00 $18,000 00 $12,000.00 $1,200.00 $10,800.00 $120.00 $10,680 00 $4.272.00 $6,408.00 $3158 00 2014 $25,000.00 $15,000.00 $10,000.00 $1.000.00 $9,000.00 $160.00 $8,840.00 $3,536 00 $5,304.00 $2,65200 2015 2014 Balance Sheet (in Thousands Assets Cash and marketable securities Accounts receivable Inventories Total current assets Net fixed assets (PPSE) Total assets $1,600.00 $6,150 00 $8.00000 $15,750.00 $12.000.00 $27.750,00 $1,000.00 $5,000.00 $6,000.00 $12,000.00 $10.000.00 $22000.00 Labilities and equity Accounts payable Notes payable Accruals Total current liabilities Long term bonds Total liabilities Common stock (2 million shares) Retained earnings Total common equity Total liabilities and equity $7,500.00 $500.00 $4,500.00 $12500.00 $1,000.00 $13,500.00 $6,000.00 $9250.00 $14 250.00 S274750.00 $6,000.00 $1000.00 $3.000.00 $10,000 00 $1.000.00 $11 000 00 $6,000.00 $5,000.00 $11.000.00 $22.000.00 O $3,730 O $1,130 $1,840 O $3.190 $2.510 ann.honninck com is sharinn var roroon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts