Question: Given the financial statements below for Dragonfly Enterprises, what would be the internal growth rate (IGR) if the company decided to change the dividend payout

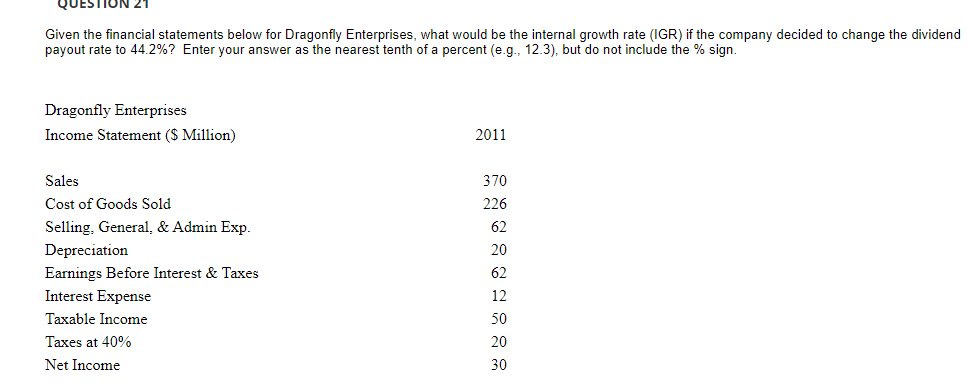

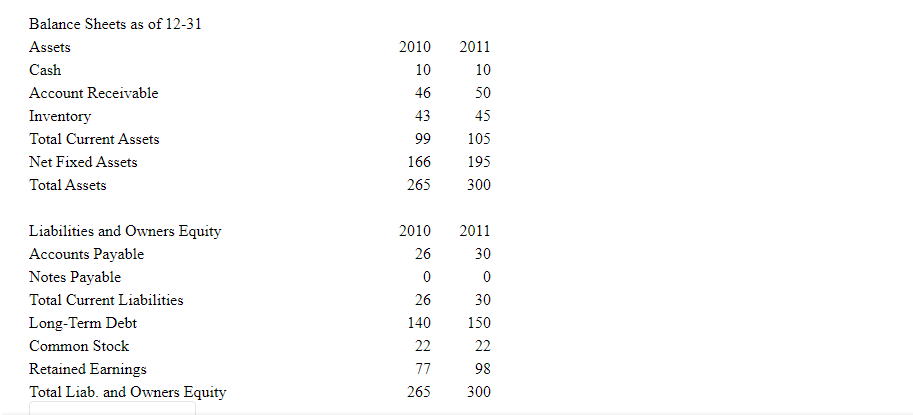

Given the financial statements below for Dragonfly Enterprises, what would be the internal growth rate (IGR) if the company decided to change the dividend payout rate to 44.2%? Enter your answer as the nearest tenth of a percent (e.g., 12.3), but do not include the % sign. Dragonfly Enterprises Income Statement ($ Million) 2011 370 226 62 20 Sales Cost of Goods Sold Selling, General, & Admin Exp. Depreciation Earnings Before Interest & Taxes Interest Expense Taxable Income Taxes at 40% Net Income 62 12 50 20 30 2010 10 46 Balance Sheets as of 12-31 Assets Cash Account Receivable Inventory Total Current Assets Net Fixed Assets Total Assets 43 99 166 265 2011 10 50 45 105 195 300 2010 26 0 26 Liabilities and Owners Equity Accounts Payable Notes Payable Total Current Liabilities Long-Term Debt Common Stock Retained Earnings Total Liab. and Owners Equity 2011 30 0 30 150 22 98 300 140 22 77 265

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts