Question: Given the five following stocks, please discuss the correlation coefficients of these five stocks and the betas of these five stocks. Are the beta estimates

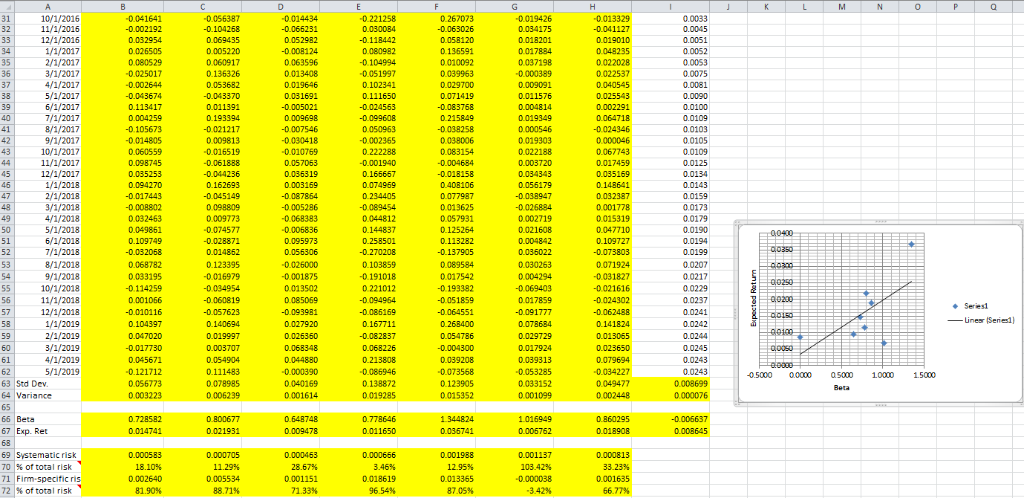

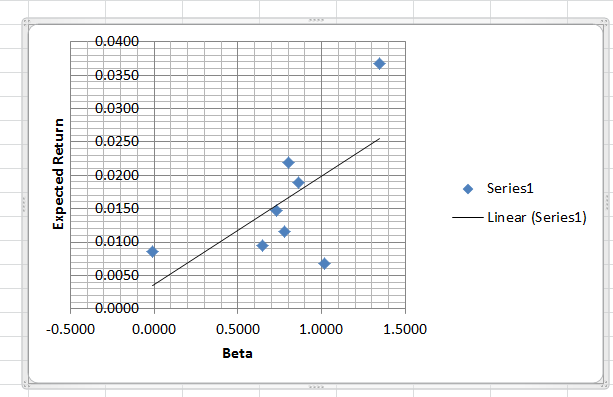

Given the five following stocks, please discuss the correlation coefficients of these five stocks and the betas of these five stocks. Are the beta estimates consistent with your expectation of cyclical stocks or defensive stocks? Is the firm-specific risk in your 5-security portfolio lower than that of an individual stock? What does that imply? From the graph of the security market line, please discuss which stocks are overvalued or undervalued.

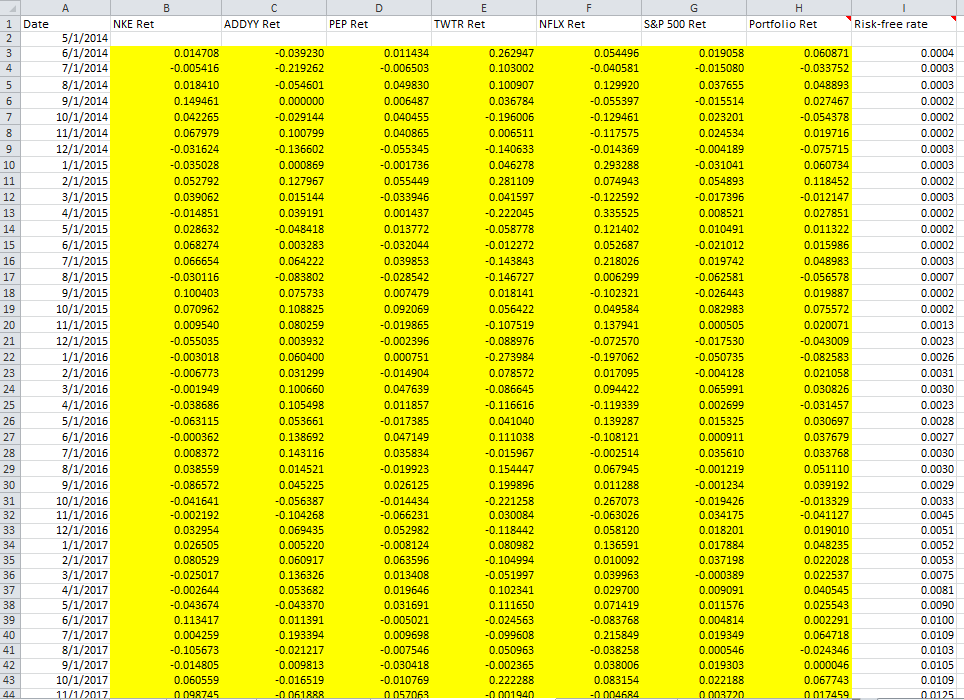

J K L O P Q M N A G D66231 11/1/2016 o 002192 0 034175 0 041127 33 12/1/2016 0.032954 0.069435 0.052982 -0.118442 0.058120 0.018201 0.019010 0.0051 037188 2/1/2017 0.O63596 0104994 0 010092 0.022028 36. 3/1/2017 0.025017 0.136326 0013408 -0.051997 0.039963 -0.000389 0.022537 0.0075 4/1/2017 6/1/2017 7/1/2017 0.040545 37 0.002644 0.053682 0.102341 0.029700 0.009091 0.019646 .0081 0.002291 0.0100 20 0.113417 0.011391 -0.005021 -0.024563 -0.083768 0.004814 0.064718 0.0109 40 0.004259 0.193394 0.009698 -0.099608: 0.215849 0.019349 C813 9/1/2017 10/1/2017 0.014805 0 000046 -0 030418 -0 002365 0.038006 0.019303 o0105 0.060559 -0.016519 -0.010769 0.222288 0.083154 0.022188 0.067743 0.0109 43 7//2037 035753 0363 19 0 166657 0 034343 o0134 0 g35169 -0.018158 0.0143 46 1/1/2018 0.094270 0.162693 0.003169 0.074969 0.408106 0.056179 0.148641 47 0.017443 -0.045149 o 013625 c01778 4/1/2018 00179 49 0.032463 0.009773 -0.068383 0.044812 0.057931 0.002719 0.015319 5/1/2018 0.049861 -0.006836 0.047710 0.0190 50 -0.074577 0.144837 0.125264 0.021608 00400 dloasa 7/1/2018 0014857 0 O32068 0.0199 0.056306 -0.270208 -0.137905 0.036022 -0.073803 53 8/1/2018 9/1/2018 0.068782 0.123395 -0.026000 0.103859 0.089584 0.030263 0.071924 0.0207 0.033195 54 0.016979 -0.001875 -0.191018 0.017542 0.004294 -0.031827 0.0217 11/1/2018 12/1/2018 go20 0.0237 56 0.001066 0 060819 0.085069 -0.094964 -0.051859 0.017859 -0.024302 Series -0.062488 57 -0.010116 -0.057623 -0.093981 -0.086169 -0.064551 -0.091777 0.0241 REdoiso 1/1/2019 0.140694 58 0.104397 0.078684 0.0242 0.167/12 .268400 0.02/920 0.11824 gooso 3/1/2019 4/1/2019 5/1/2019 -0.017730 -0.004300 0.025650 0.0245 60 0.003707 0.068348 0.068226 0.017924 0.079694 0.0243 61 0.045671 0.054904 0.044880 0.213808 0.039208 0.039313 1483 .0243 -0.5000 00000 aso00 10000 15000 130873 12380 Std Dev 64 Variance Beta 0.003223 0002448 0.000076 0.006239 0.001614 0019285 0015352 0.001099 65 31023 coETE 67 Exp. Ret o 014741 0eza 018908 o011650 o n36701 086/5 68 69 Systematic risk 0.000583 0.000705 0.000453 0.000656 0.001988 0.001137 0.000813 0.o00na8 Eicm.n o 001635 m02640 0.c05534 o 001151 pq18619 eritic ri 0013365 88.71 % 1.33 % 7.05 % 3.42 % .77 % of total risk 81.90% 554% 0.0400 0.0350 0.0300 0.0250 0.0200 Series1 O.0150 Linear (Series1) 0.0100 0.0050 0000 0 0.0000 -0.5000 0.5000 1.0000 1.5000 Beta Expected Return J K L O P Q M N A G D66231 11/1/2016 o 002192 0 034175 0 041127 33 12/1/2016 0.032954 0.069435 0.052982 -0.118442 0.058120 0.018201 0.019010 0.0051 037188 2/1/2017 0.O63596 0104994 0 010092 0.022028 36. 3/1/2017 0.025017 0.136326 0013408 -0.051997 0.039963 -0.000389 0.022537 0.0075 4/1/2017 6/1/2017 7/1/2017 0.040545 37 0.002644 0.053682 0.102341 0.029700 0.009091 0.019646 .0081 0.002291 0.0100 20 0.113417 0.011391 -0.005021 -0.024563 -0.083768 0.004814 0.064718 0.0109 40 0.004259 0.193394 0.009698 -0.099608: 0.215849 0.019349 C813 9/1/2017 10/1/2017 0.014805 0 000046 -0 030418 -0 002365 0.038006 0.019303 o0105 0.060559 -0.016519 -0.010769 0.222288 0.083154 0.022188 0.067743 0.0109 43 7//2037 035753 0363 19 0 166657 0 034343 o0134 0 g35169 -0.018158 0.0143 46 1/1/2018 0.094270 0.162693 0.003169 0.074969 0.408106 0.056179 0.148641 47 0.017443 -0.045149 o 013625 c01778 4/1/2018 00179 49 0.032463 0.009773 -0.068383 0.044812 0.057931 0.002719 0.015319 5/1/2018 0.049861 -0.006836 0.047710 0.0190 50 -0.074577 0.144837 0.125264 0.021608 00400 dloasa 7/1/2018 0014857 0 O32068 0.0199 0.056306 -0.270208 -0.137905 0.036022 -0.073803 53 8/1/2018 9/1/2018 0.068782 0.123395 -0.026000 0.103859 0.089584 0.030263 0.071924 0.0207 0.033195 54 0.016979 -0.001875 -0.191018 0.017542 0.004294 -0.031827 0.0217 11/1/2018 12/1/2018 go20 0.0237 56 0.001066 0 060819 0.085069 -0.094964 -0.051859 0.017859 -0.024302 Series -0.062488 57 -0.010116 -0.057623 -0.093981 -0.086169 -0.064551 -0.091777 0.0241 REdoiso 1/1/2019 0.140694 58 0.104397 0.078684 0.0242 0.167/12 .268400 0.02/920 0.11824 gooso 3/1/2019 4/1/2019 5/1/2019 -0.017730 -0.004300 0.025650 0.0245 60 0.003707 0.068348 0.068226 0.017924 0.079694 0.0243 61 0.045671 0.054904 0.044880 0.213808 0.039208 0.039313 1483 .0243 -0.5000 00000 aso00 10000 15000 130873 12380 Std Dev 64 Variance Beta 0.003223 0002448 0.000076 0.006239 0.001614 0019285 0015352 0.001099 65 31023 coETE 67 Exp. Ret o 014741 0eza 018908 o011650 o n36701 086/5 68 69 Systematic risk 0.000583 0.000705 0.000453 0.000656 0.001988 0.001137 0.000813 0.o00na8 Eicm.n o 001635 m02640 0.c05534 o 001151 pq18619 eritic ri 0013365 88.71 % 1.33 % 7.05 % 3.42 % .77 % of total risk 81.90% 554% 0.0400 0.0350 0.0300 0.0250 0.0200 Series1 O.0150 Linear (Series1) 0.0100 0.0050 0000 0 0.0000 -0.5000 0.5000 1.0000 1.5000 Beta Expected Return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts