Question: Given the following bond prices use the bootstrap method to calculate the spot rates for 1 through 5 years. (You must solve algebraically and show

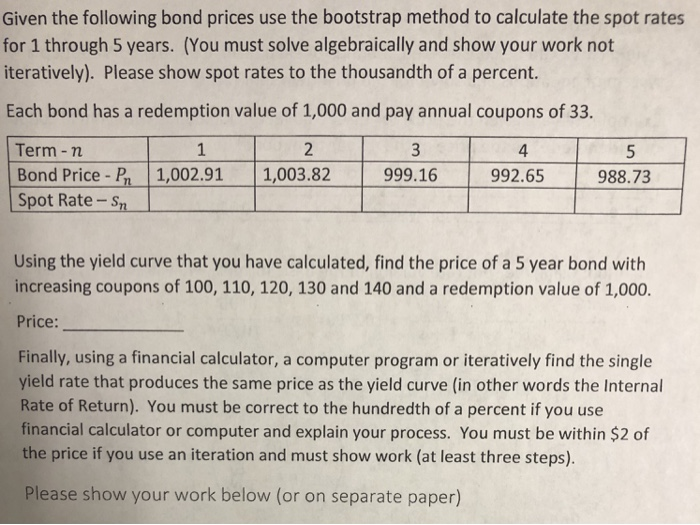

Given the following bond prices use the bootstrap method to calculate the spot rates for 1 through 5 years. (You must solve algebraically and show your work not iteratively). Please show spot rates to the thousandth of a percent. Each bond has a redemption value of 1,000 and pay annual coupons of 33. Term -n Bond Price-P 1,002.911,003.82 999.16 992.65 988.73 Spot Rate Sn 4 Using the yield curve that you have calculated, find the price of a 5 year bond with increasing coupons of 100, 110, 120, 130 and 140 and a redemption value of 1,000. Price: Finally, using a financial calculator, a computer program or iteratively find the single yield rate that produces the same price as the yield curve (in other words the Internal Rate of Return). You must be correct to the hundredth of a percent if you use financial calculator or computer and explain your process. You must be within $2 of the price if you use an iteration and must show work (at least three steps). Please show your work below (or on separate paper)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts