Question: Given the following case, answer questions 18 and 20 below: Group Co. currently has 4,000 shares outstanding each sold for $100, whereas, Intel Inc. has

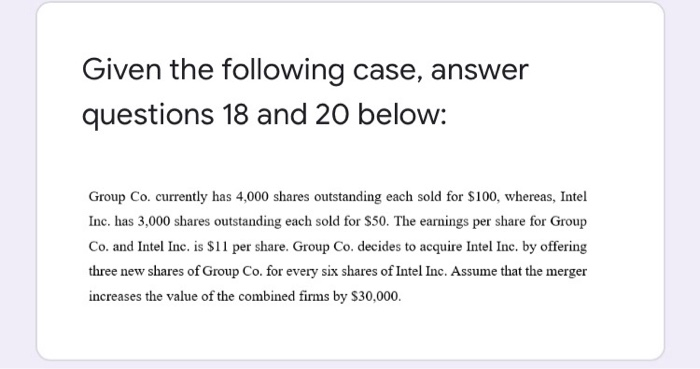

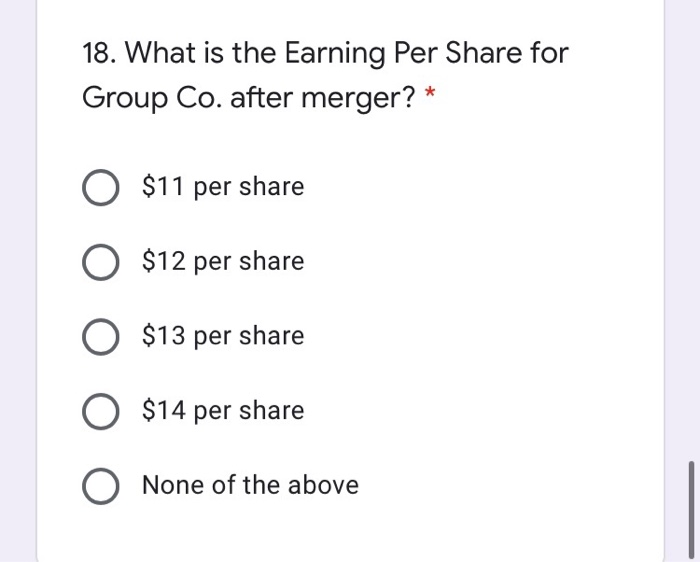

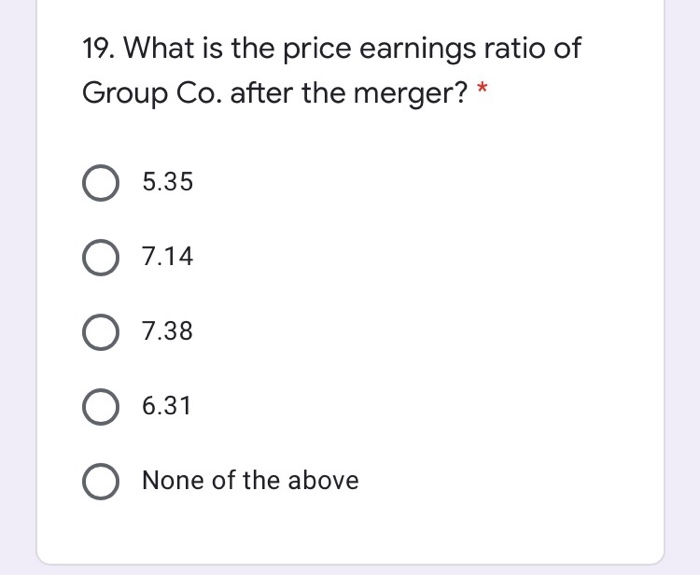

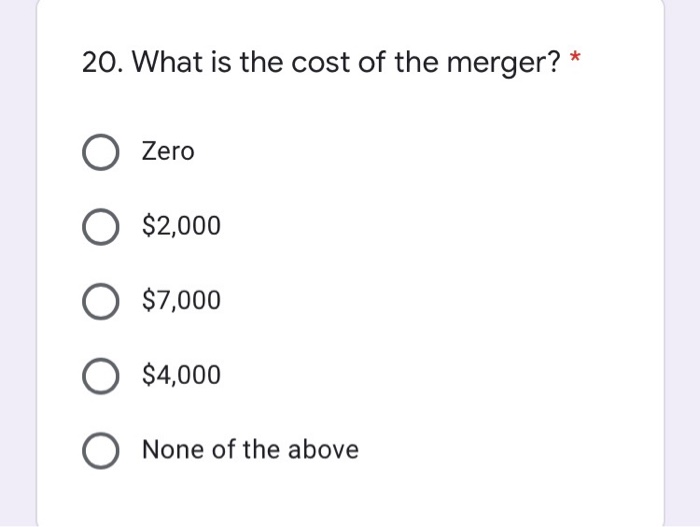

Given the following case, answer questions 18 and 20 below: Group Co. currently has 4,000 shares outstanding each sold for $100, whereas, Intel Inc. has 3,000 shares outstanding each sold for $50. The earnings per share for Group Co. and Intel Inc. is $11 per share. Group Co. decides to acquire Intel Inc. by offering three new shares of Group Co. for every six shares of Intel Inc. Assume that the merger increases the value of the combined firms by $30,000. 18. What is the Earning Per Share for Group Co. after merger? * O $11 per share $12 per share O $13 per share O $14 per share O None of the above 19. What is the price earnings ratio of Group Co. after the merger? * 5.35 O 7.14 O 7.38 O 6.31 None of the above 20. What is the cost of the merger? Zero $2,000 $7,000 $4,000 None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts